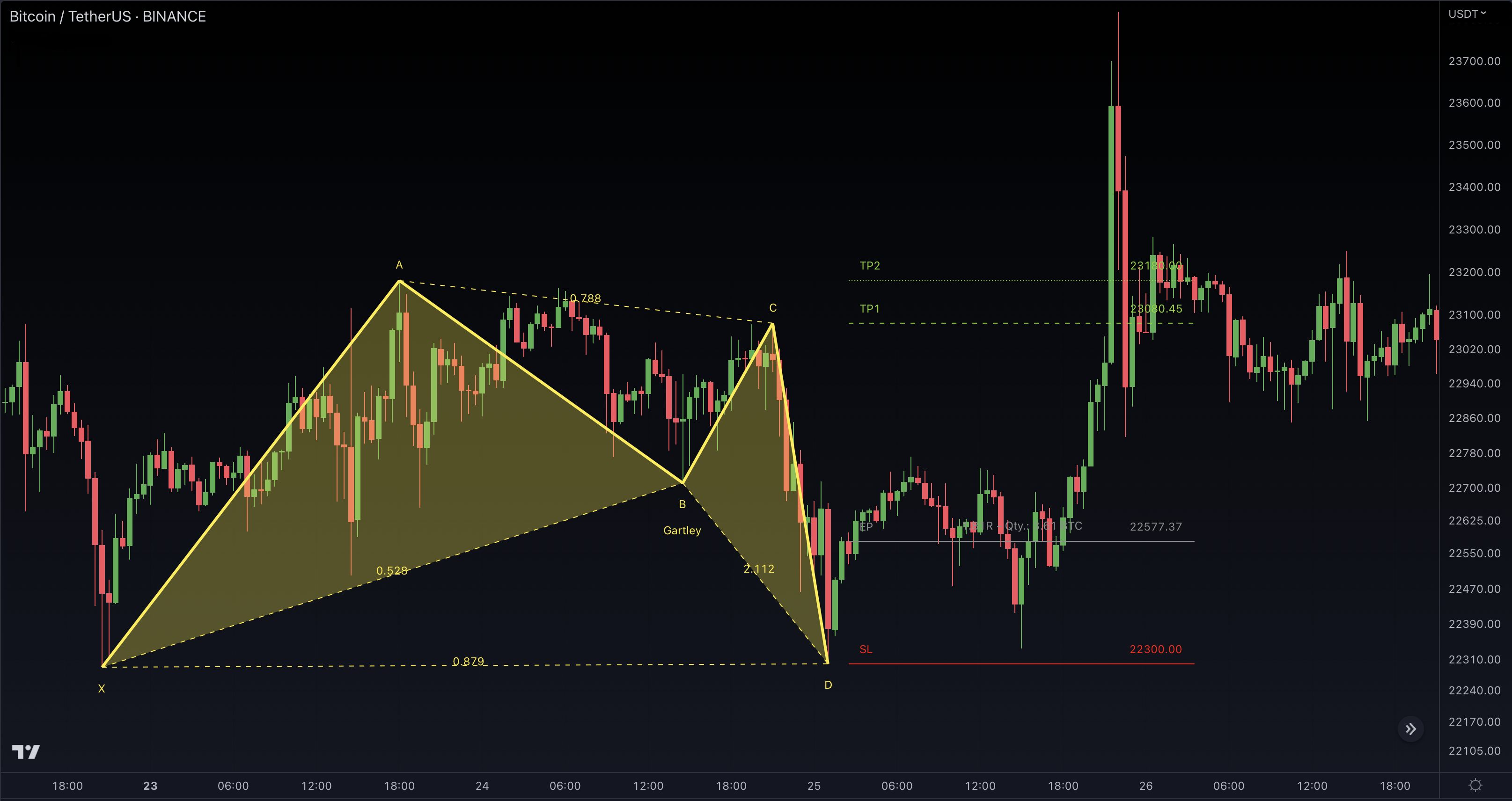

Gartley Pattern

The Gartley pattern is composed of a series of price swings and retracements that form specific geometric shapes based on Fibonacci ratios.

The Gartley pattern is characterized by a specific sequence of price moves, including an initial impulse leg, followed by a retracement that forms the X point, another leg that forms the A point, a deeper retracement that forms the B point, a C point that forms with a retracement to the 0.618 or 0.786 Fibonacci level of the initial impulse leg, and finally, a completion of the pattern at the D point, which forms with a retracement to the 0.786 Fibonacci level of the XA leg.

Traders use the Gartley pattern to identify potential entry and exit points in the market, as well as to set stop-loss and take-profit levels.