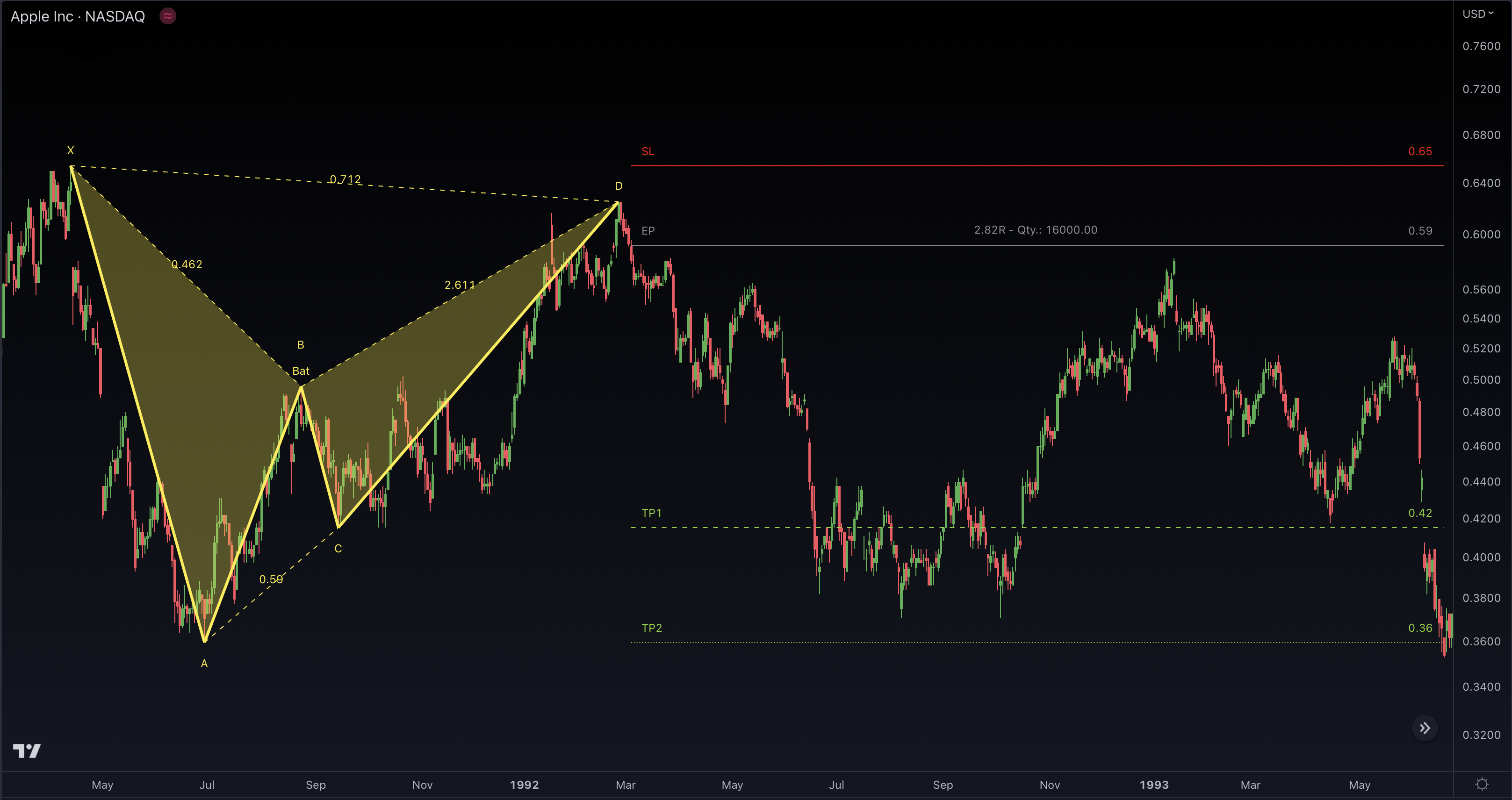

Bat Pattern

The Bat pattern derives its name from the distinctive shape of a bat's wings, which it resembles when plotted on a price chart.

The Bat pattern is composed of a specific sequence of price movements, including an initial impulse leg, a retracement that forms the X point, another leg that forms the A point, a deeper retracement forming the B point, a C point that forms with a retracement to the 0.382 or 0.618 Fibonacci level of the initial impulse leg, and finally, a completion of the pattern at the D point. The D point forms with a retracement to the 0.886 or 1.618 Fibonacci level of the XA leg.

Traders who are skilled in identifying the Bat pattern can use it to pinpoint potential entry and exit points in the market, as well as to set stop-loss and take-profit levels. However, it is important to note that the Bat pattern is less common than other harmonic patterns, such as the Gartley and Butterfly patterns. As such, it may require more experience and practice to identify accurately. Fortunately, our Harmonic Patterns Suite indicator does all this time-consuming work for you.