Head And Shoulders Pattern

The head and shoulders pattern is one of the most reliable trend reversal formations in technical analysis. Our advanced detection tool helps traders identify these patterns with precision and accuracy.

Understanding the Pattern

The head and shoulders chart pattern consists of three key components:

- Left Shoulder: Initial peak in an uptrend

- Head: Higher peak forming the central point

- Right Shoulder: Final peak at similar height to left shoulder

- Neckline: Support level connecting the troughs

Types of Patterns

Classic Head and Shoulders

A bearish reversal pattern forming after an uptrend, characterized by:

- Three peaks with the middle one (head) being the highest

- Two lower peaks (shoulders) of roughly equal height

- A neckline connecting the lows between peaks

Inverse Head and Shoulders

A bullish reversal pattern forming after a downtrend, featuring:

- Three troughs with the middle one being the lowest

- Two higher troughs of similar depth

- A neckline connecting the highs between troughs

Features

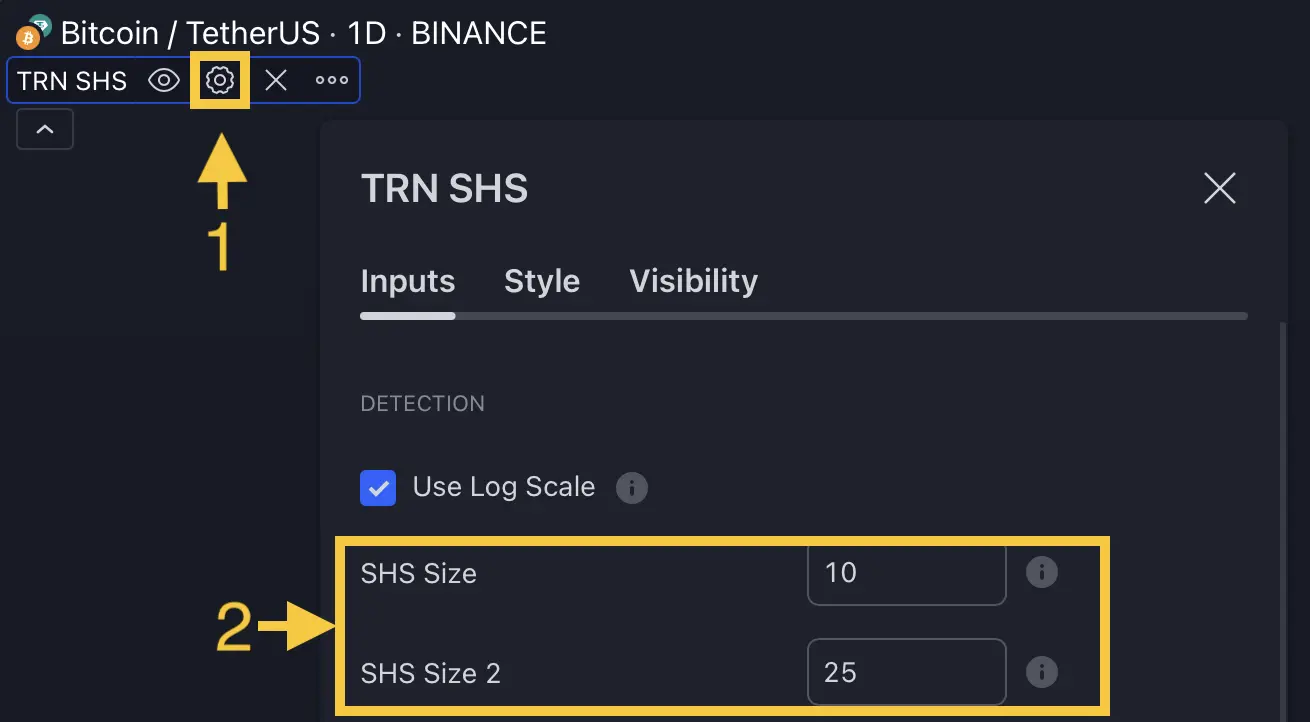

Pattern Detection Setup

Our indicator uses two distinct swing sizes for precise pattern detection:

- Access Settings: Open indicator settings (1)

- Adjust Parameters: Navigate to "Detection" section (2)

- Configure Swing Sizes:

- Default first swing size: 10

- Default second swing size: 25

Larger swing sizes detect major trend reversals, while smaller sizes catch shorter-term pattern formations.

FAQ

How reliable are head and shoulders patterns?

Head and shoulders patterns are among the most reliable chart patterns when properly identified.

Which timeframes work best for head and shoulders patterns?

The pattern works on all timeframes, but higher timeframes (4H, Daily) typically produce more reliable signals. Learn more in our usage guide.

What confirms a head and shoulders pattern?

Key confirmation signals include neckline breakout, increased volume on the break, and a retest of the neckline. See our pattern guide for detailed confirmation strategies.