Trend Bars Pro Trading Strategies

HTF Analysis Integration

The TRN Trend Bars Pro indicator achieves superior accuracy by combining High Time Frame (HTF) Candles with precision signal detection. This comprehensive guide explains how to leverage HTF Reversal Bars and Continuation Bars for optimal trade execution.

Signal Bar Framework

Key Signal Types:

- Reversal Bars: Direction change indicators

- Continuation Bars: Trend persistence signals

Strategic Implementation

1. Timeframe Selection

Choose appropriate timeframe combinations:

| Trading Timeframe | Analysis Timeframe |

|---|---|

| 15s/30s | 5m |

| 1m | 15m |

| 3m/5m | 1h |

| 15m | 4h |

| 1h | 1D |

| 4h | 1D/1W |

| 1D | 1W |

| 1W | 1M |

2. Signal Recognition

Monitor for specific bar patterns:

- Bullish Signals:

- Reversal Bars: Upward momentum initiation

- Continuation Bars: Uptrend confirmation

- Bearish Signals:

- Reversal Bars: Downward momentum initiation

- Continuation Bars: Downtrend confirmation

3. Trade Management

Risk Control Measures:

- Stop-Loss Placement: Beyond recent swings

- Take-Profit Targets: Key levels or R-multiple targets

Integrated Analysis Approach

Combining Multiple Indicators

The power of Trend Bars Pro multiplies when combined with:

- Dynamic Trend Analysis

- Bar Range Studies

- Pattern Recognition

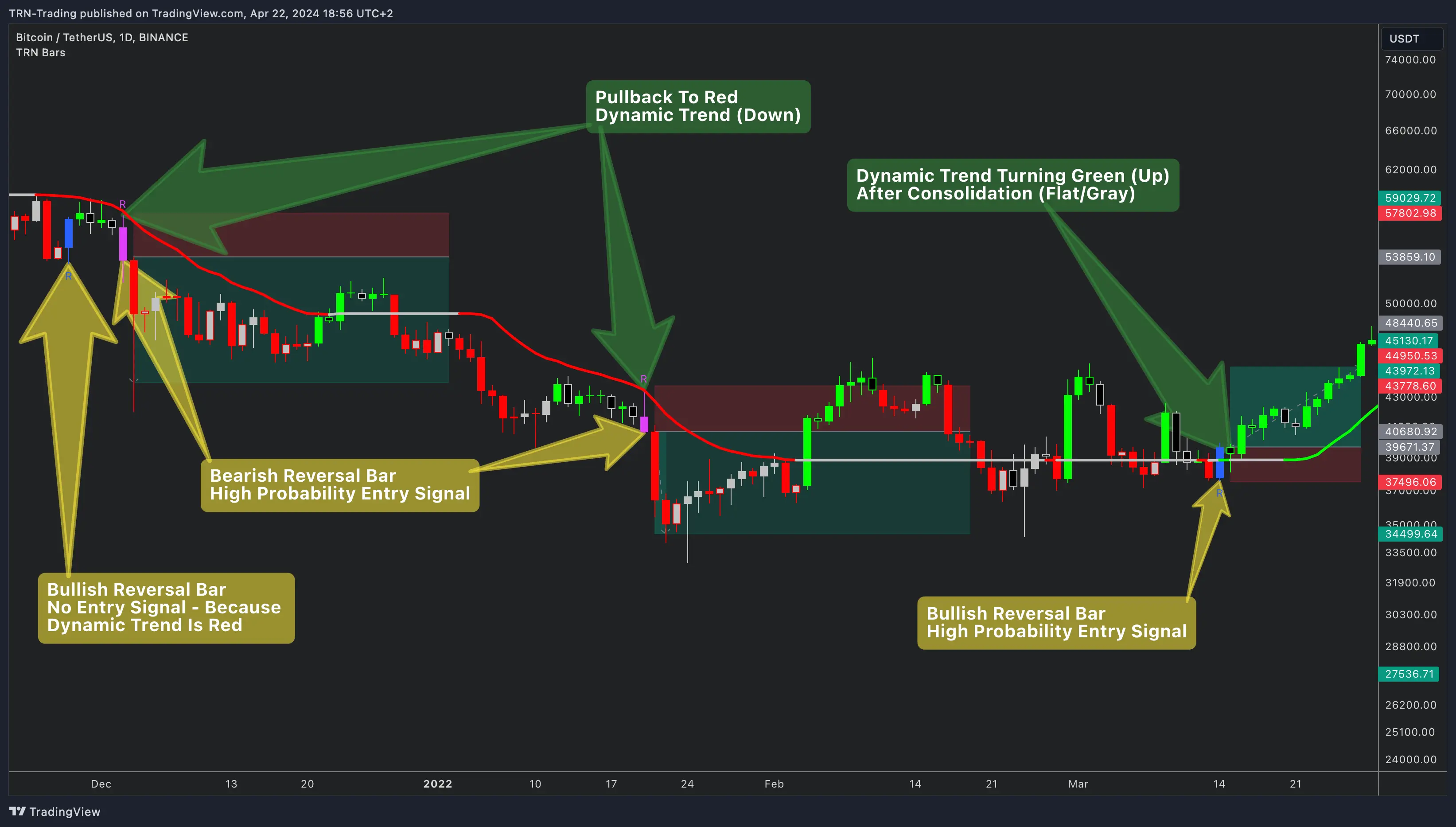

High-Probability Setups

Optimal entry conditions include:

- Signal bar alignment with Dynamic Trend

- Range breakout confirmation

- Volume confirmation

Range Analysis Integration

Key considerations:

- Range identification

- Breakout validation

- Signal bar confirmation

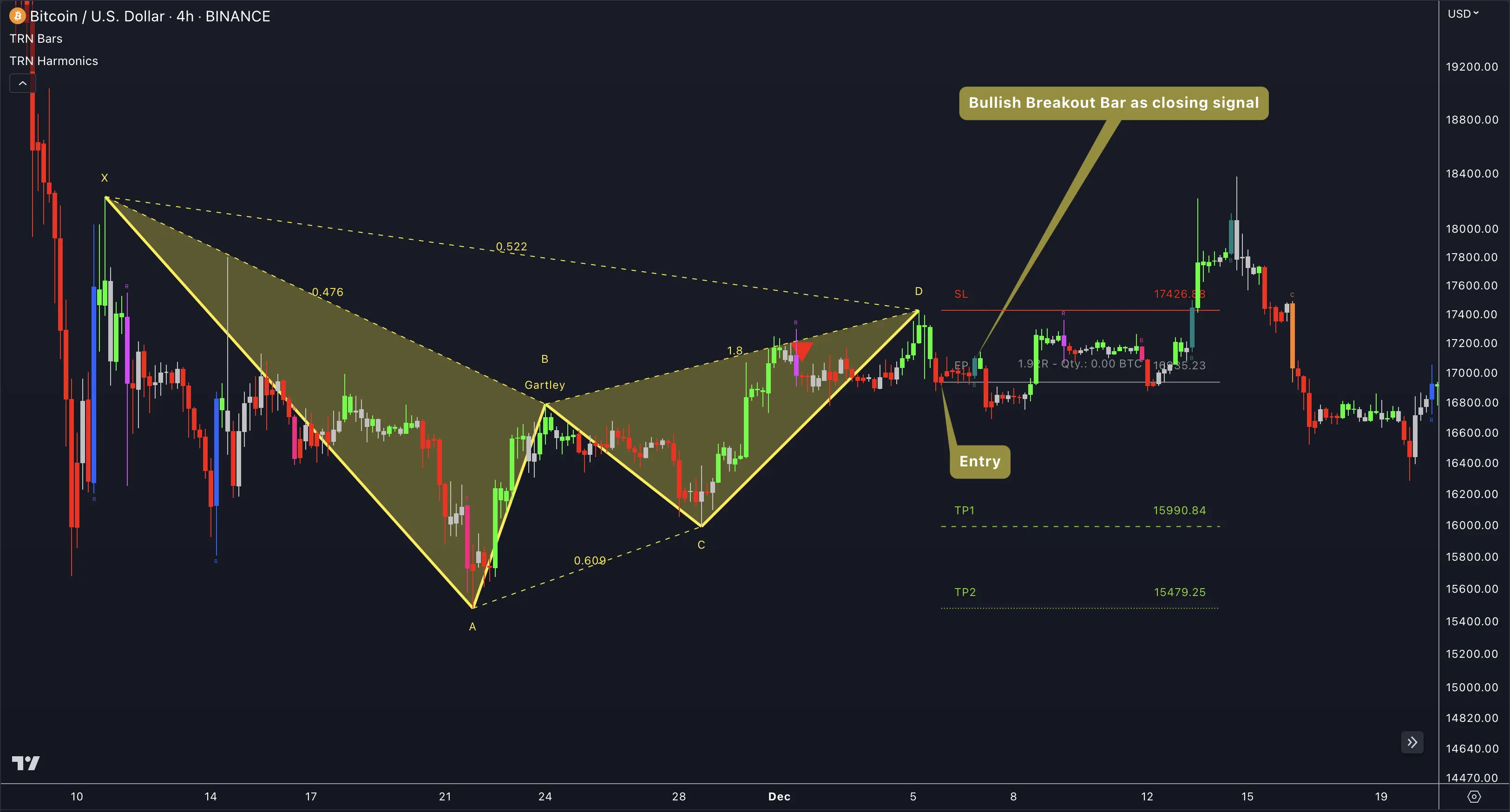

Pattern Trading Integration

Trend Bars Pro enhances pattern trading through:

- Harmonic pattern confirmation

- Consolidation breakout validation

- Divergence confirmation

Explore our comprehensive Combinations Guide for advanced setups.

Position Management

Signal-Based Decisions

Monitor positions using:

- Reversal bar exits

- Continuation bar scaling

- Breakout bar confirmation

Configure custom alerts for automated signal detection. Learn more in our Alerts Guide.

FAQ

Which timeframe combination works best?

The 4H/Daily combination often provides the most reliable signals for swing trading, while 15M/1H works well for day trading.

How many confirmations should I wait for?

Look for at least two confirming factors: signal bar alignment with trend direction and support from either Dynamic Trend or range analysis.

What's the recommended risk management approach?

Use a maximum 1% risk per trade, with stops placed beyond the signal bar's range and targets at key technical levels or 2-3R multiples.