Bar Range

Price ranges are fundamental to understanding market behavior and volatility. They represent the high and low prices of an asset during a specific timeframe, providing crucial insights for trading decisions.

Understanding Price Ranges

Price ranges vary significantly based on:

- Asset type (stocks, crypto, forex)

- Market conditions

- Timeframe analyzed

- Volatility levels

For example, cryptocurrency markets often exhibit wider ranges than traditional assets due to their inherent volatility.

TRN Bar Range Implementation

Our bar range analysis tool provides multiple strategic advantages:

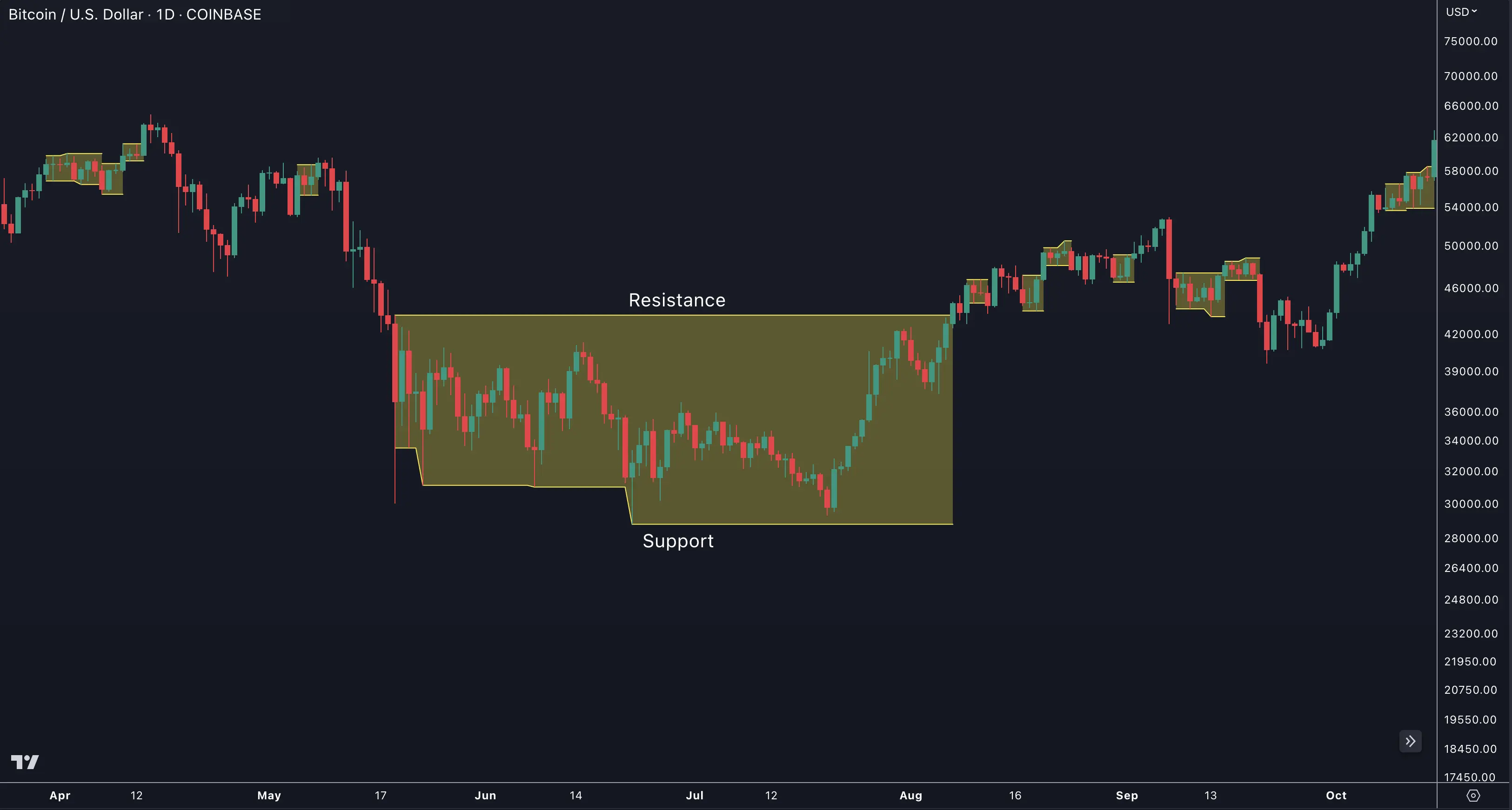

1. Support and Resistance Detection

Key Level Identification:

- Support levels: Areas of strong buying pressure

- Resistance levels: Zones of significant selling pressure

- Range boundaries: Clear market structure points

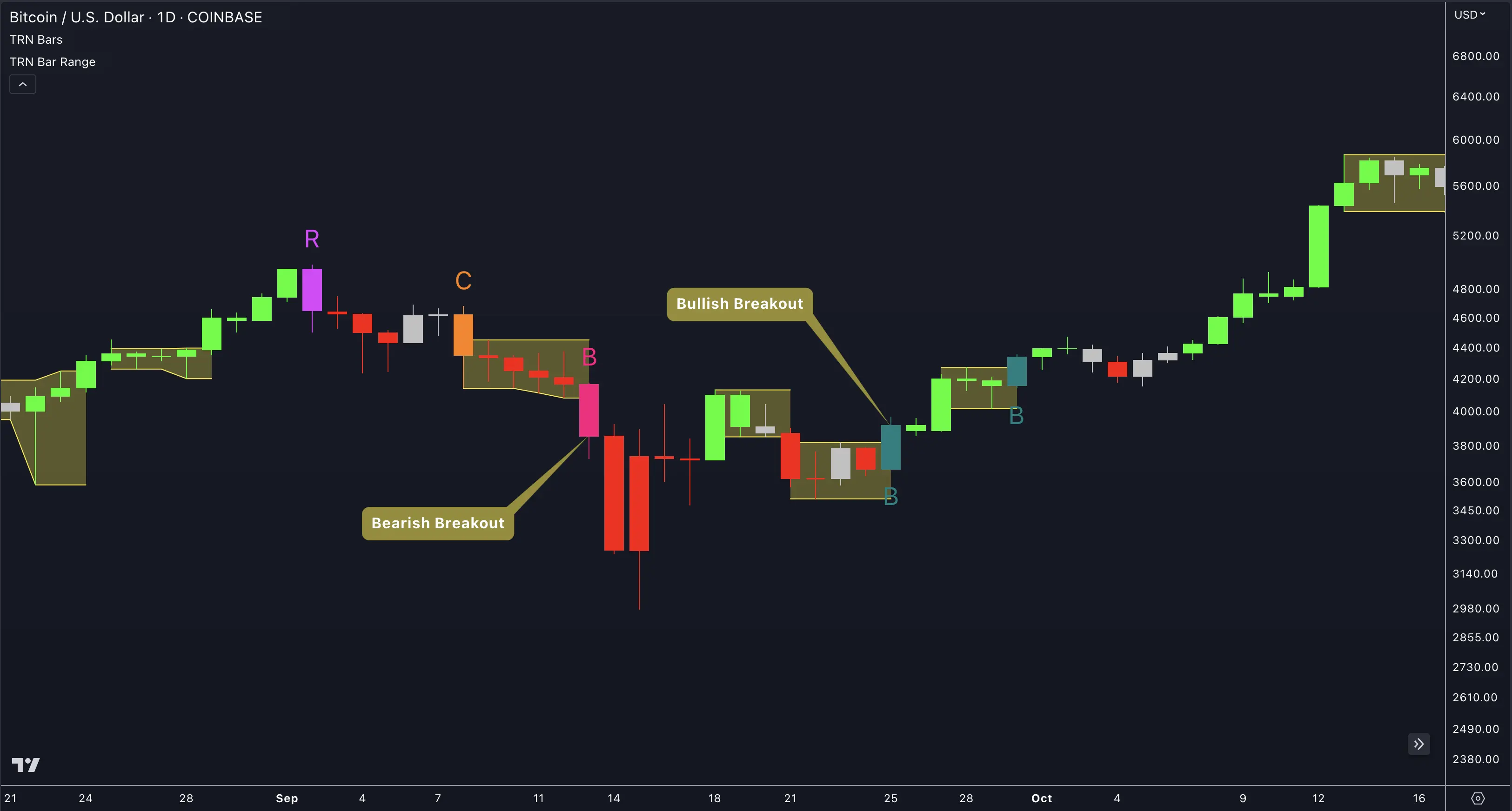

2. Breakout Trading Strategy

Trading Opportunities:

- Monitor range boundaries

- Confirm breakouts with TRN Signal Bars

- Trade in breakout direction

- Use range size for position sizing

3. Strategic Stop Placement

Optimize risk management through:

- Range-based stop positioning

- Volatility-adjusted stops

- Multi-timeframe confirmation

4. Volatility Analysis

Assess market conditions through:

- Range width analysis

- Consolidation identification

- Breakout potential evaluation

- Volume correlation

Advanced Trading Applications

Range Trading Strategy

-

Range Identification

- Monitor price containment

- Assess range validity

- Track range duration

-

Entry Tactics

- Buy near support

- Sell near resistance

- Confirm with trend analysis

-

Risk Management

- Place stops beyond range

- Scale position sizes to range

- Monitor range integrity

FAQ

Which timeframe is best for range analysis?

While ranges can be analyzed on any timeframe, daily and 4-hour charts often provide the most reliable range formations for swing trading.

How do I confirm valid range breakouts?

Look for breakout confirmation through signal bars, increased volume, and strong momentum in the breakout direction.

Where should I place stops when trading ranges?

Place stops beyond the opposite range boundary, accounting for typical market volatility and false breakout levels.