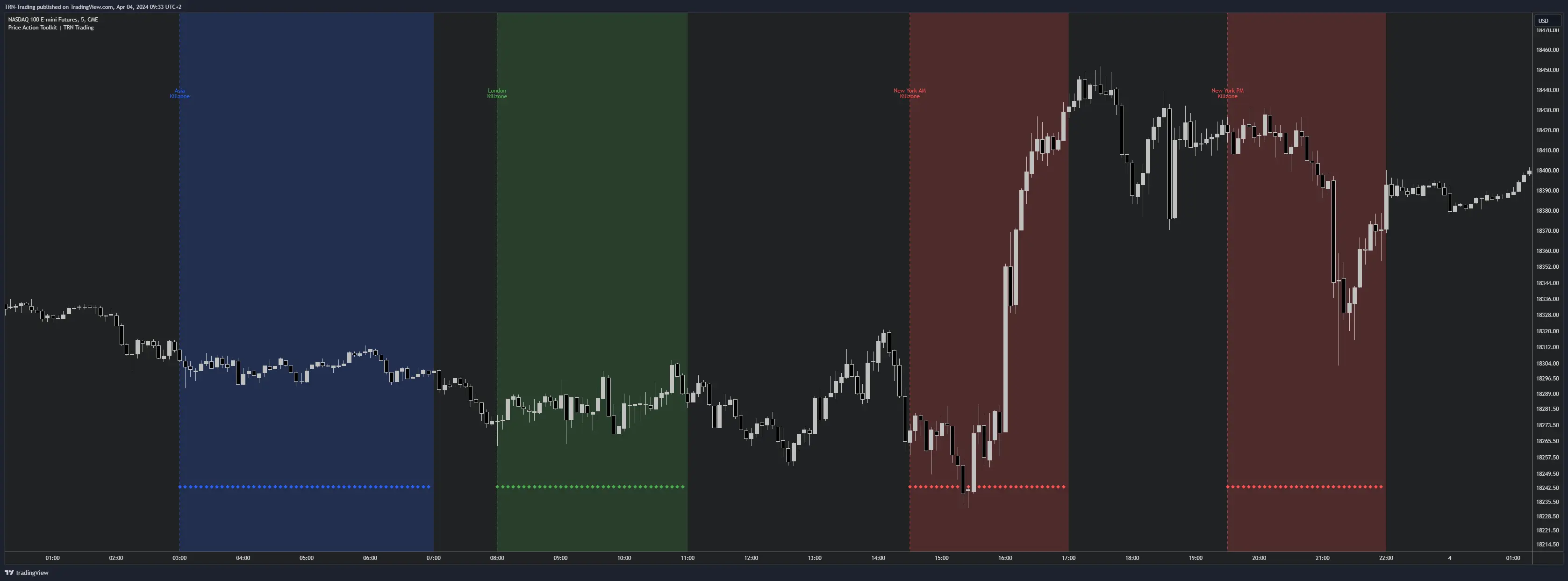

Kill Zones Trading

A Kill Zone represents a specific time period with heightened market volatility and liquidity, offering prime opportunities for traders to capitalize on significant price movements.

Types of Kill Zones

-

Indices/Futures Kill Zones

- Optimal for ES, NQ, FDAX trading

- Prime times for CL and stocks

- Options market opportunities

- Pre/post market activity

-

Forex Kill Zones

- Major currency pair activity

- Session overlap periods

- High liquidity windows

- Bank trading hours

-

Opening Range Kill Zones

- Market open volatility

- First hour trading

- Gap trading opportunities

- Morning momentum

Trading Characteristics

Each Kill Zone offers unique advantages:

-

Market Conditions

- Increased volatility

- Higher trading volume

- Tighter spreads

- Institutional activity

-

Trading Opportunities

- Breakout setups

- Trend initiations

- Range expansions

- Volume spikes

Combine Kill Zone timing with Market Structure and Volume Imbalances for optimal entries.

FAQ

What exactly is a Kill Zone?

A Kill Zone is a specific time period during the trading day characterized by increased volatility and liquidity. These periods often coincide with major market opens and session overlaps, providing excellent trading opportunities.

Which Kill Zone is best for trading?

The best Kill Zone depends on your market: Futures traders often prefer the US market open, Forex traders focus on London/NY overlap, while stock traders might concentrate on the first hour of trading.

How do you trade Kill Zones effectively?

Trade Kill Zones by preparing for increased volatility, watching for Order Blocks and Market Structure breaks, and being ready for quick moves. Always have a clear plan before the zone begins.