Head And Shoulders Patterns Trading Strategies

Master the art of trading head and shoulders patterns with our comprehensive guide. Learn to identify, confirm, and execute trades with precision.

Pattern Trading Strategy

1. Pattern Identification

Key identification steps:

- Add the indicator to your chart

- Look for clear shoulder-head-shoulder formation

- Confirm pattern symmetry and proportions

- Validate with volume analysis

Set up alerts to get notified when patterns form or break out on your preferred timeframes.

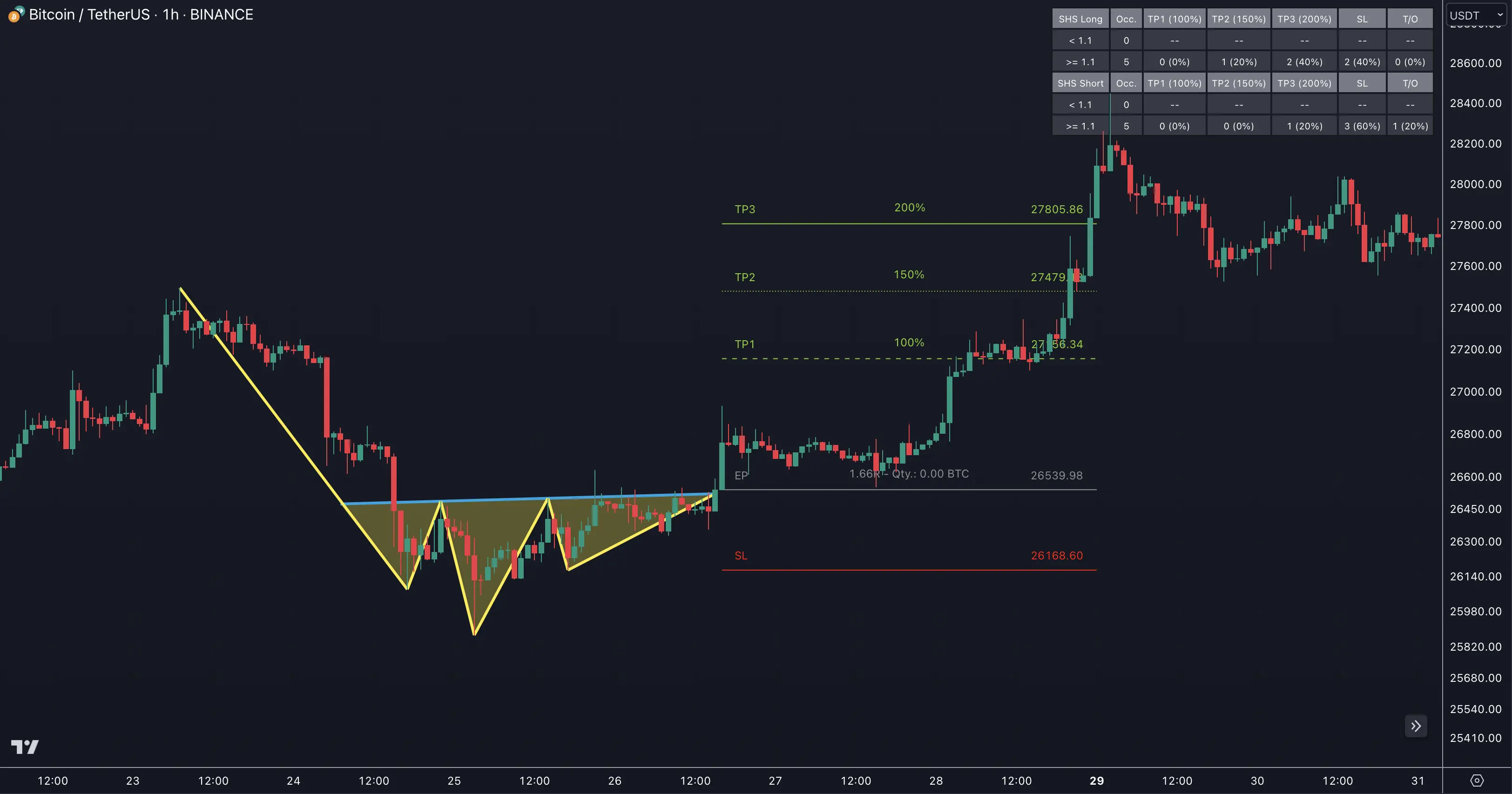

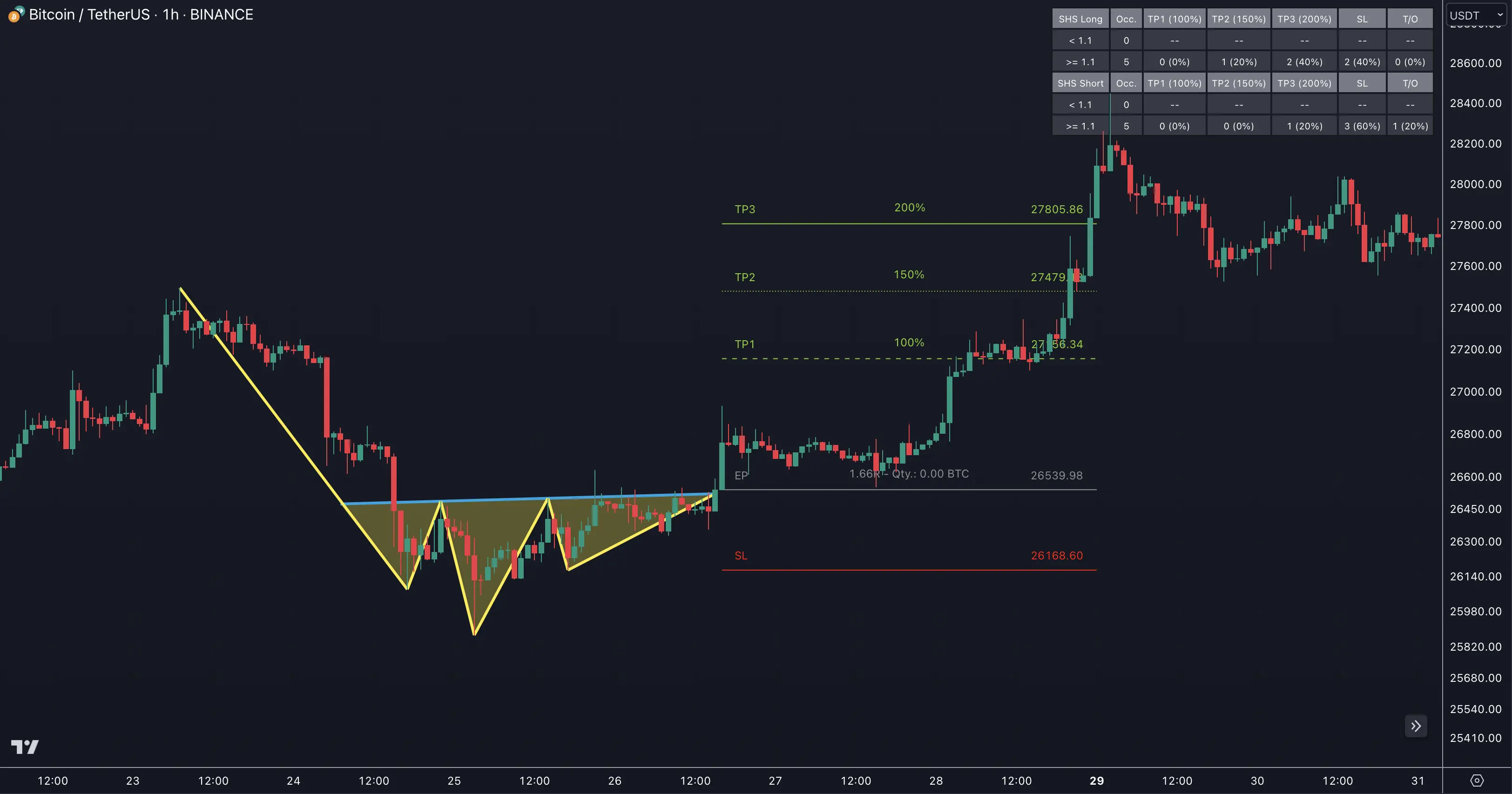

2. Pattern Confirmation

Breakout Recognition

- Watch for the grey entry point line (EP)

- Confirm neckline breach:

- Below red neckline for bearish patterns

- Above blue neckline for bullish patterns

Volume Validation

- Look for increasing volume on breakout

- Compare volume across pattern formation

- Confirm trend direction

3. Trade Execution

Entry Strategies

-

Conservative Entry:

- Wait for neckline breakout

- Enter on first retest

- Confirm with volume

-

Aggressive Entry:

- Enter at pattern completion

- Use tighter stops

- Scale in on breakout

4. Risk Management

Stop Loss Placement

- Set stops at the red SL line

- Consider volatility

- Account for market noise

Take Profit Targets

Three profit targets available:

- TP1: Conservative target (1.5R)

- TP2: Moderate target (2R)

- TP3: Aggressive target (3R)

5. Trade Management

Position Monitoring

- Use Trend Bars Pro for trend confirmation

- Track volume for breakout validation

- Monitor pattern completion

Exit Strategies

-

Partial Exits:

- Scale out at each TP level

- Move stops to breakeven

- Protect profits

-

Full Exit:

- Pattern completion

- Target reached

- Stop hit

Advanced Features

Market Scanner

Scan multiple markets simultaneously:

- Up to 20 different symbols

- Real-time pattern detection

- Automated alerts

Learn more about our powerful Chart Pattern Scanner for automated pattern detection.

FAQ

What's the best timeframe for trading head and shoulders patterns?

The pattern works on all timeframes, but 4H and Daily charts typically provide more reliable signals with better risk-reward ratios. See our statistics for detailed performance data.

How can I avoid false breakout signals?

Wait for volume confirmation, use multiple timeframe analysis, and combine with Trend Bars Pro for trend validation. Consider using wider stops in volatile markets.

What's a good risk-reward ratio for these patterns?

Aim for a minimum 1:1.5 risk-reward ratio, though our statistics show better performance with 1:2 or higher. Learn more in our risk management guide.