Rectangle Pattern Trading Strategies

Master the art of trading rectangle patterns with our comprehensive guide. Learn proven strategies for entries, exits, and risk management.

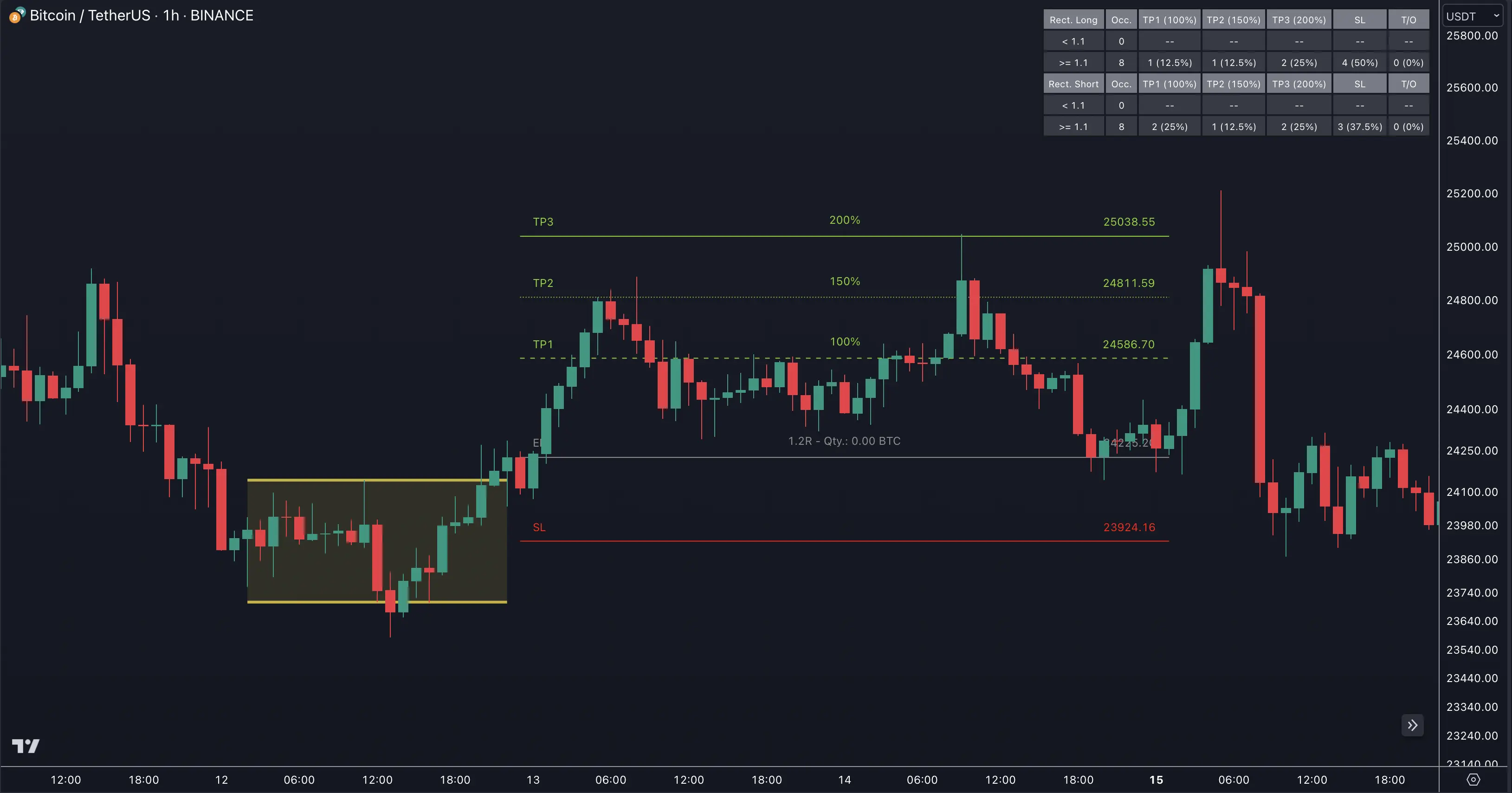

Trading Strategy Overview

1. Pattern Identification

Add the Rectangle Pattern Scanner to your chart and look for high-probability setups:

- Clear support and resistance levels

- Consistent price action

- Volume confirmation

Set up alerts for real-time pattern notifications across multiple timeframes.

Use our Chart Pattern Scanner to scan up to 40 symbols simultaneously for rectangle patterns.

2. Entry Strategy

Identify optimal entry points using our EP (Entry Point) indicator:

- Bullish Breakouts: Enter above resistance at EP line

- Bearish Breakouts: Enter below support at EP line

Risk Management

Stop-Loss Placement

Place your stop-loss orders at the designated SL (Stop Loss) line for:

- Risk control

- Position sizing

- Trade management

Take-Profit Targets

Multiple profit targets are provided:

- TP1: Conservative target (base R:R calculation)

- TP2: Intermediate target

- TP3: Aggressive target

Enhance your trade management with Swing Suite statistics for optimal results.

Trade Monitoring

Active Management

- Monitor price action near boundaries

- Watch for volume confirmation

- Track momentum indicators

Use Trend Bars Pro for enhanced trade monitoring and trend confirmation.

FAQ

When is the best time to enter a rectangle pattern trade?

Enter after a confirmed breakout with volume confirmation. Check pattern statistics for optimal entry timing based on historical performance.

How should I size my positions in rectangle pattern trades?

Use our built-in risk management calculator to determine optimal position size based on your account and risk parameters.

How can I avoid false breakouts?

Wait for volume confirmation and use Trend Bars Pro for additional confirmation. Consider using wider stops during volatile market conditions.