How To Trade Head And Shoulders Pattern

1. Identify The Pattern

Add the Head And Shoulders Pattern indicator to your chart and look for the pattern on the asset and timeframe of your choice.

You can also use the alerts to easy getting notified when a pattern is in the making or gets confirmed on the Symbol and timeframe of your choice. Please check out our Alerts section to learn how to use them.

With our Market Scanner you can search for harmonic patterns on up to 40 different symbols at the same time. Just get notified when a pattern is found, breaks out or is confirmed.

Visit our Chart Pattern Scanner section to see how it works.

2. Identify The Breakout Point

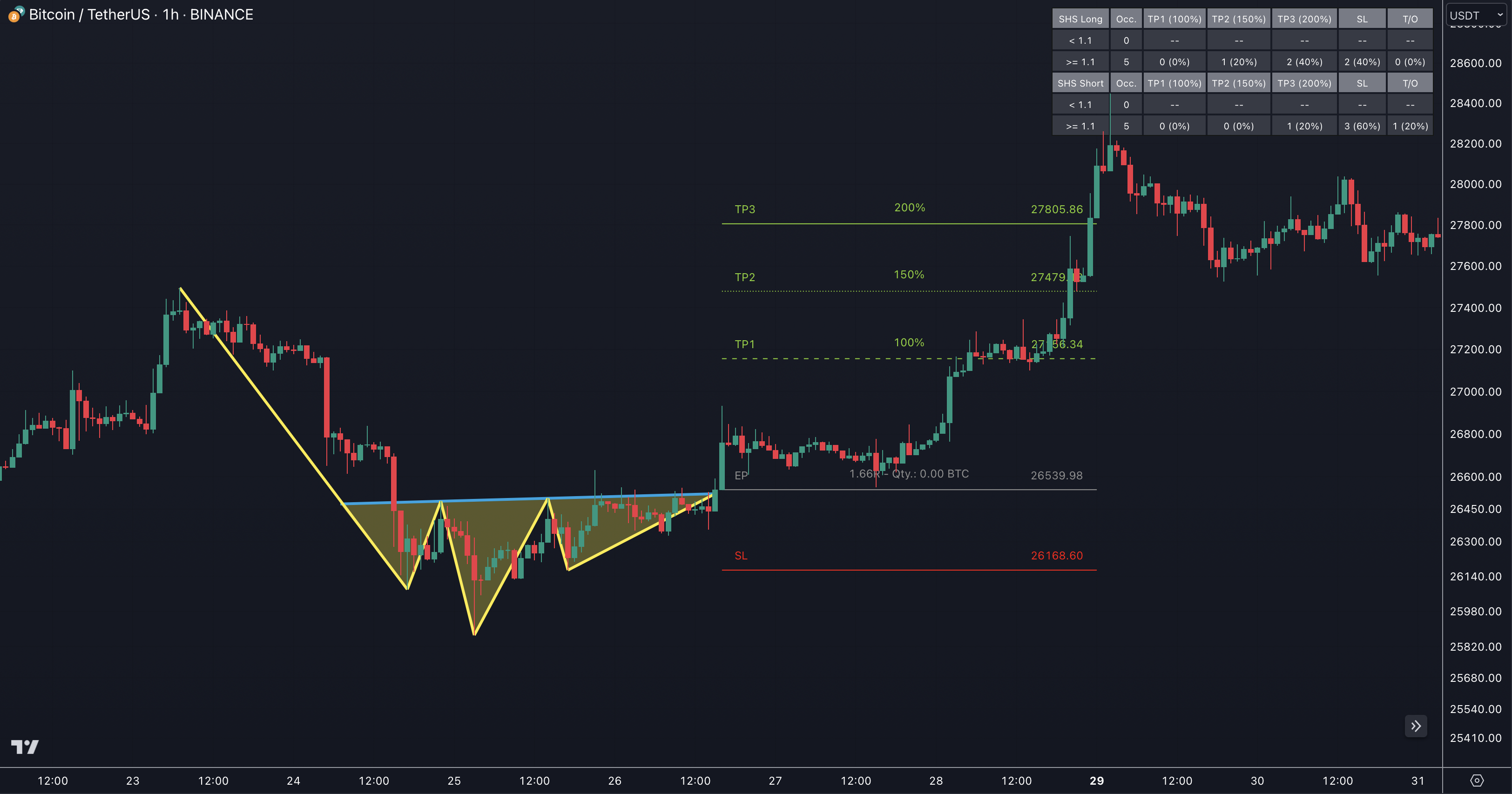

Look for the grey line (EP) at the point where the price breaks below the red neckline or above the blue neckline for the inverse Shoulder Head Shoulder pattern, indicating a trend reversal.

3. Place Your Order

Once the breakout point has been identified, place a sell order near the price level of the grey entry point line (EP) under the neckline or place a sell order near the price level of the EP line above the neckline for inverse Shoulder Head Shoulder patterns.

4. Set Stop-Loss And Take-Profit Levels

Set your stop-loss at the price level of the red stop-loss line (SL). Set your take-profit at the price level of one of the green take-profit-lines (TP1, TP2, TP3). Take into account that your risk/reward ratio (R) was calculated on the basis of TP1.

5. Monitor Your Trade

Once you've entered the trade, monitor it closely. Adjust your stop loss and profit target as the price moves, and consider exiting the trade if the price starts to move against you.

Utilize the Trend Bars Pro to effectively monitor your trades. Discover the inner workings of this tool by referring to the designated section How To Use Trend Bars Pro.

It's important to note that not all shoulder head shoulder patterns will play out as expected, and there is always the risk of a false signal. As with any trading strategy, it's important to do your research, use risk management techniques, and have a solid trading plan in place before entering a trade based on the head and shoulders pattern.