Divergence Detection (Divergence Suite)

The TRN SMT/Divergence Suite works with any given indicator, even custom ones. In addition, there are 11 built-in indicators. We have chosen a selection of different momentum, trend following and volume oscillators that gives you maximum flexibility. Most noticeable is the cumulative delta indicator, which works astonishingly well as a divergence indicator.

Following is the full list of the build in indicators/oscillators:

- AO

- CDV

- RSI

- W%R

- MFI

- Stochastic

- MACD

- CCI

- ADX

- ATR

- Cumulative Delta

Types of Divergences

What Are Divergences?

When the price of an asset moves in one direction, but its indicators move in the opposite direction, this is called a divergence. Divergences can be a powerful signal that a trend reversal is about to occur.

Regular Divergences

There are two types of regular divergences:

- Bullish divergence: Occurs when price makes lower low but indicator shows higher low

- Bearish divergence: Occurs when price makes higher high but indicator shows lower high

Hidden Divergences

Hidden divergences indicate potential trend continuation:

- Hidden Bearish Divergence: Price higher high + Indicator lower high

- Hidden Bullish Divergence: Price lower low + Indicator higher low

How to Use the Divergence Detector

Step-by-Step Guide

-

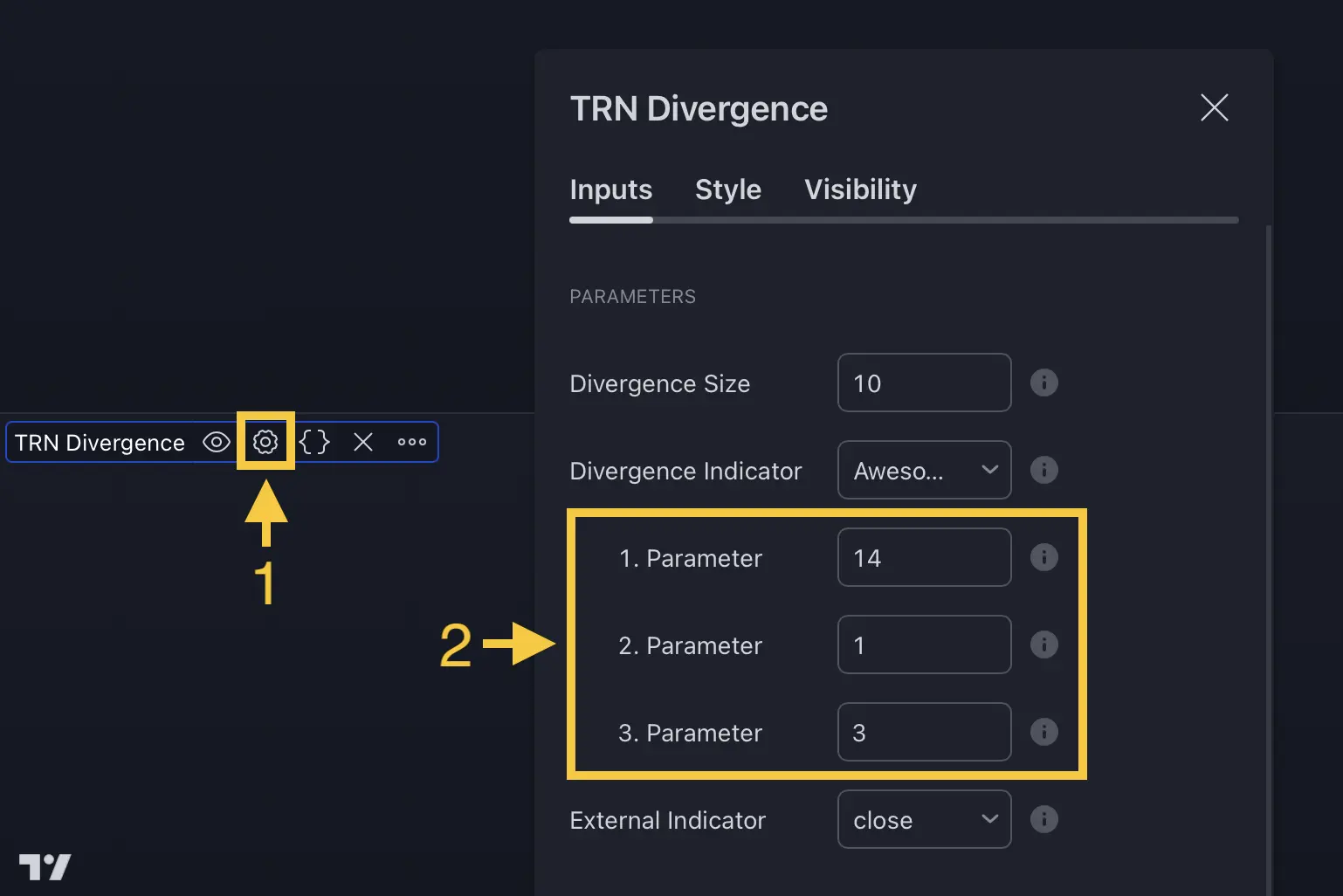

Access Settings

- Open indicator settings (1)

- Navigate to "Parameters" section (2)

-

Select Oscillator

- Choose from 11 built-in options (3)

- Default: Awesome Oscillator (AO)

-

Interpret Results

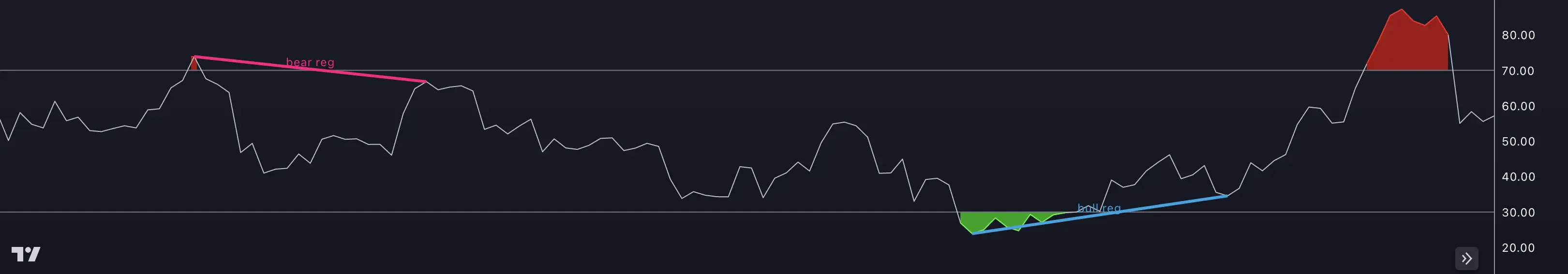

- Blue lines = Bullish divergence

- Red lines = Bearish divergence

Combine divergence signals with Trend Bars Pro alerts for confirmation

FAQ

Which oscillator is best for divergence detection?

The Cumulative Delta (CDV) and RSI are popular choices, but experiment with all 11 built-in indicators to find what works for your strategy.

How reliable are divergence signals?

While powerful, divergences should always be confirmed with additional tools like Trend Bars Pro or price action analysis.

Can I use custom indicators with the suite?

Yes! The SMT/Divergence Suite works seamlessly with any TradingView-compatible indicator. Learn more about custom indicator integration.