Swing Statistics

Unveil the untapped potential of the advanced Swing Statistics! Gain invaluable insights into historical swings and turning points that will revolutionize your trading approach. Elevate your expertise by harnessing this treasure trove of data to supercharge signal reliability, while masterfully planning stop loss and take profit strategies with unrivaled accuracy.

Swing Suite empowers you with a roadmap of past occurrences, guiding you towards future prosperity. Embrace the cutting-edge technology that paves the way for enhanced trading proficiency.

How To Setup Swing Statistics

To configure Swing Statistics, follow these simple steps:

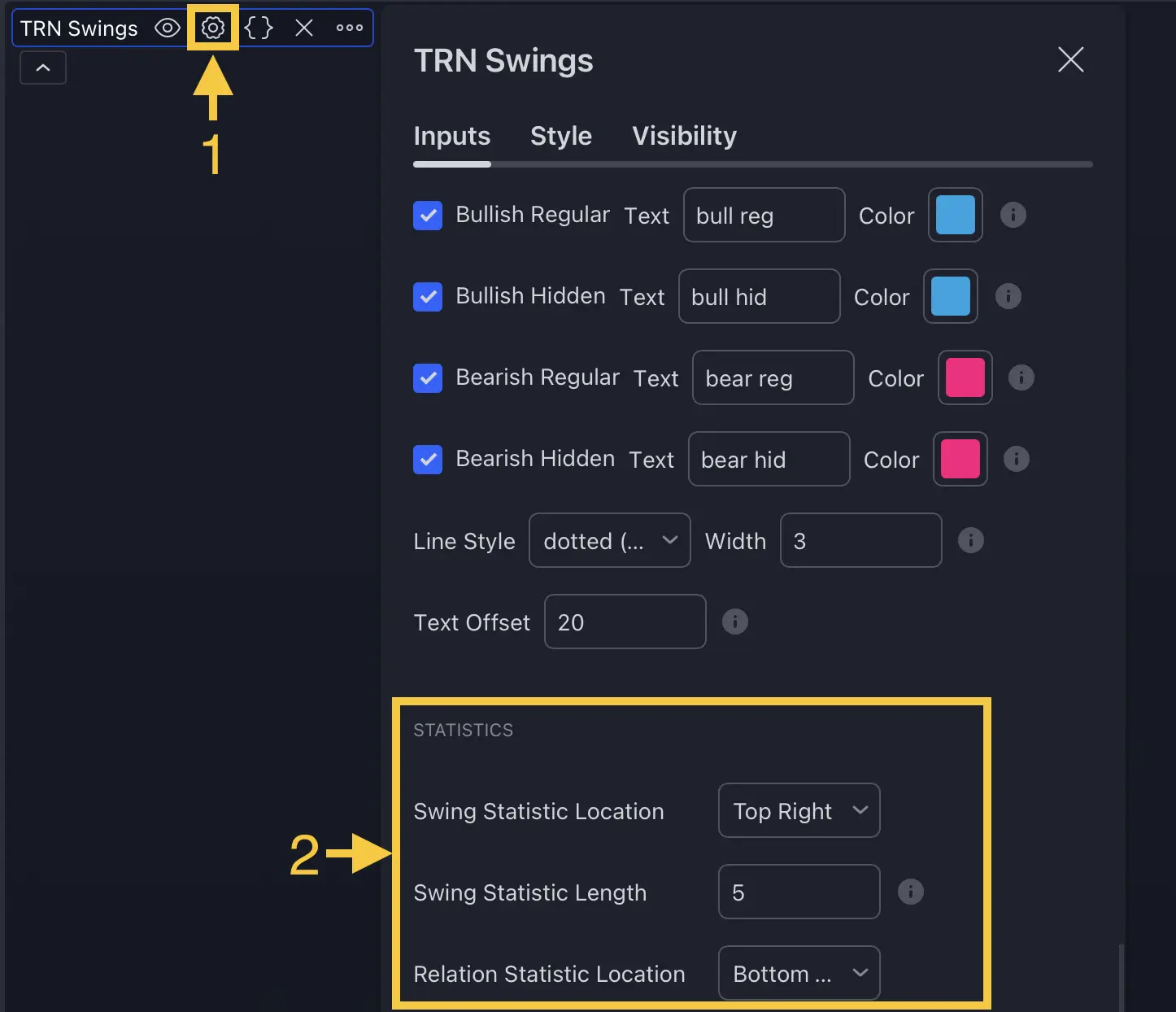

- Access the indicator settings (1).

- Scroll down to the "Statistics" section (2).

- Within this section, you have the option to adjust the Length of the Swing Statistic. By default, it is set to 5 swings. This value determines the number of past swings considered when calculating the average swing length.

Make sure to customize the Length according to your preferences to obtain the most relevant and accurate swing analysis for your trading needs.

Furthermore, you have the flexibility to select the Location of the Swing Statistic and the Relation Statistic on your chart. This enables you to customize the display to provide a perfect overview of all essential information at a glance. Tailor the chart layout according to your preferences, ensuring that the critical data is easily accessible and readily available for your trading decisions.

How To Read Statistics

Within Swing Suite lie two powerful statistics, each offering distinct insights to empower your trading prowess.

The Swing Statistic gracing the upper right corner of the chart (1) unravels the secrets of past upswings and downswings, giving you a comprehensive understanding of market trends and patterns.

Descending to the lower right corner, we encounter the Relation Statistic (2) that provides invaluable information about the sequence of highs and lows in the past. By mapping out these crucial points, you gain the ability to spot potential turning points, making informed decisions on when to enter or exit trades.

How To Read Swing Statistic

The Swing Statistic comprises two series, one for up swings (Up) and one for down swings (Down), with values given in points. Column 2 (#) displays the total number of analyzed swings. The third column (Overall ∅ Length) represents the average length of all swings in points, while the fourth column (Overall ∅ Duration) indicates the average duration of swings in bars. Additionally, the fifth column (∅ Length) shows the average lengths for custom-defined swing counts. Finally, the sixth column (∅ Duration) provide the average durations for the corresponding custom-defined swing count.

In the case of well-established assets like Microsoft or Nvidia, which have undergone one or more stock splits, the overall average in column three may deviate significantly from those in columns five and seven. It is essential to remain mindful of this factor at all times.

How To Read Relation Statistic

The Relation Statistic presents percentages representing the historical occurrence of specific high and low sequences. In the first column (in %), various types of highs and lows are listed as reference points.

For example, the first row corresponds to "HH followed by," where the second column (#) displays the total count of higher highs (HH) considered. The subsequent columns showcase the percentages of how often certain patterns follow the initial HH. In our example, a further HH follows in 43.9% of cases (column 3 - HH), a lower high (LH) follows in 47.4% (column 4 - LH), a double top (DT) follows in 8.7% (column 5 - DT), a lower low (LL) follows in 24.5% (column 6 - LL), a higher low (HL) follows in 69.4% (column 7 - HL), and a double bottom (DB) follows in 6.1% (column 8 - DB) of all cases.

The figure above showcases the most common sequence you will frequently encounter on many assets and timeframes. It encompasses six patterns: HH followed by HL, LH followed by LL, DT followed by LL, LL followed by LH, HL followed by HH, and DB followed by HH. These patterns can be easily recognized by the distinctly marked blue fields in the figure.

Fields marked in blue represent sequences that occurred in over 50% of cases. In the example, the blue field in the first row indicates that a higher high (HH) was followed by a higher low (HL) in 69.4% of cases. The darker the shade of blue in each field, the higher the percentage.

How To Use Statistics

Set Stop-Loss And Take-Profit Levels For TRN Chart Patterns

Unlock the full potential of the Swing statistic to fine-tune your stop loss and take profit levels with unparalleled precision for all our TRN Chart Patterns. When validating a bullish breakout from a pattern, turn to the first statistic to evaluate the average length of up swings on your selected symbol and timeframe. Scrutinize the remaining points in the ongoing up swing, aligning it with the average up swing length to ascertain the price at which this synchronization occurs. Utilize this price as an alternative Take Profit position, offering a more tailored approach compared to the given one from the pattern.

In the provided chart, we can observe that the average length of up swings is 107.08 points. To determine the target price for a bullish move, we would derive this price by adding 107.08 points to the low at point D of the Cypher pattern. This approach represents the average expected up swing, providing a valuable reference for potential price targets.

Conversely, delve into the price at which the last down swing matches the average down swing length, empowering you to establish a well-informed alternative stop loss position, optimized for your specific trading strategy.

For short trades, the methodology is easily reversed. Utilize the average length of down swings to determine your take profit target, while the average length of up swings will guide you in setting your stop loss level.

Set Stop-Loss And Take-Profit Levels For Trend Bars Pro & Swing Suite/Divergence Signals

Harness the power of the Swing statistic to elevate your precision in setting stop loss and take profit levels for Signals from Trend Bars Pro & Swing Suite. When a bullish breakout bar is confirmed following a bullish RSI Divergence, delve into the first statistic to assess the average length of up swings on your chosen symbol and timeframe. Analyze the points remaining in the current up swing to match the average up swing length and determine the price at which this alignment occurs. Utilize this price as your Take Profit position.

In the above example, a confirmed blue reversal bar following a hidden bullish divergence serves as the entry signal. We can observe that the average length of up swings is 442.64 points. To determine the target price for a bullish move, we would calculate this price by adding 442.64 points to the Higher Low (HL), which is also the low of the Bullish reversal bar. This approach provides a valuable reference for potential price targets, representing the average expected upswing.

The average length of down swings, on the other hand, is -516.98 points. However, the last down swing from the Higher High (HH) to the Higher Low (HL) exceeds this average length. As a result, the low of the bullish reversal bar has been established as the Stop Loss level. If the last down swing had been shorter than the average length of -516.98 points, a new alternative Stop Loss would have been determined, positioned below the current level.

Validate Stop-Loss And Take-Profit Levels

No matter which of our signals you choose to trade, consulting Swing Statistic 2 can significantly enhance the reliability of these signals.

For example, when encountering a bullish breakout after a lower low (LL), you can examine the likelihood of a subsequent lower high (LH) or even a higher high (HH). Combining this valuable information with your predetermined Take Profit level allows you to better assess whether your target can be achieved successfully.

Similarly, you can verify the probability of the next low being a higher low (HL) or another lower low (LL) to determine the likelihood of your Stop Loss being triggered.

The table in the above example reveals that there is a 67.9% chance of a Higher High (HH) following the Lower Low (LL) at point D. With such a significant probability, it is advisable to position the take-profit at a price level above the last high.

Furthermore, the table indicates a 63.3% probability of a Higher Low (HL) occurring after the Lower Low (LL) at point D. This high probability bolsters the belief that the set stop-loss will not be triggered since it was placed at the LL at point D, implying that a double bottom (DB) or another Lower Low (LL) would need to form for it to be activated.

By utilizing Swing Statistic 2, you empower yourself with valuable insights, equipping you to make more informed and confident trading decisions.

Combine statistical analysis with Chart Patterns for more precise trade entries and exits.

FAQ

What's the optimal Length setting for Swing Statistics?

The default setting of 5 swings works well for most timeframes. However, consider using 8-10 swings for higher timeframes (4H+) and 3-5 swings for lower timeframes for more relevant data.

How reliable are the statistical probabilities?

The probabilities are based on historical data and are most reliable when there's a significant sample size (50+ swings). Always combine with other technical tools like Trend Bars Pro for confirmation.

How do stock splits affect the statistics?

Stock splits can significantly impact the overall average swing lengths. Focus on recent swing averages (columns 5 and 7) for stocks that have undergone splits, as these provide more relevant data for current trading conditions.