Pattern Settings

Customize our patterns to fit your specific requirements by adjusting their size and accuracy. This flexibility enables you to focus on smaller patterns for quick entries and exits or expand your search to capture more patterns, even though they may come with lower accuracy.

How To Find The Perfect Settings

While our default settings are designed to suit various assets and timeframes, it's crucial to understand that patterns may not always perform consistently across all symbols and timeframes. Periods of low performance are indicating caution in trading patterns.

Utilize our pattern statistics to check pattern performance, showing how frequently a pattern was detected and its success rate.

Our Pattern Statistics make it easy for you to see how successful a Pattern is on the Asset and timeframe you are watching. You should always check them out before entering a trade. Visit our Pattern Statistics section to learn how to use and adjust them correctly.

Select The Right Swing Size

Our patterns rely on our unique swing detection algorithm. Larger swings result in the detection of larger patterns.

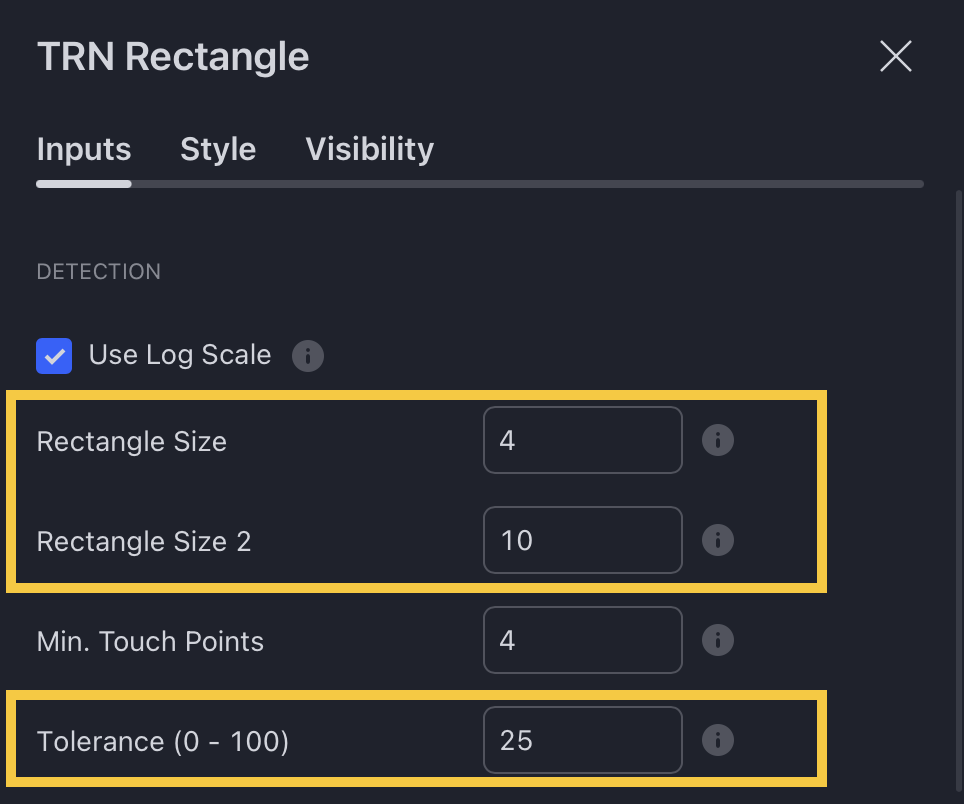

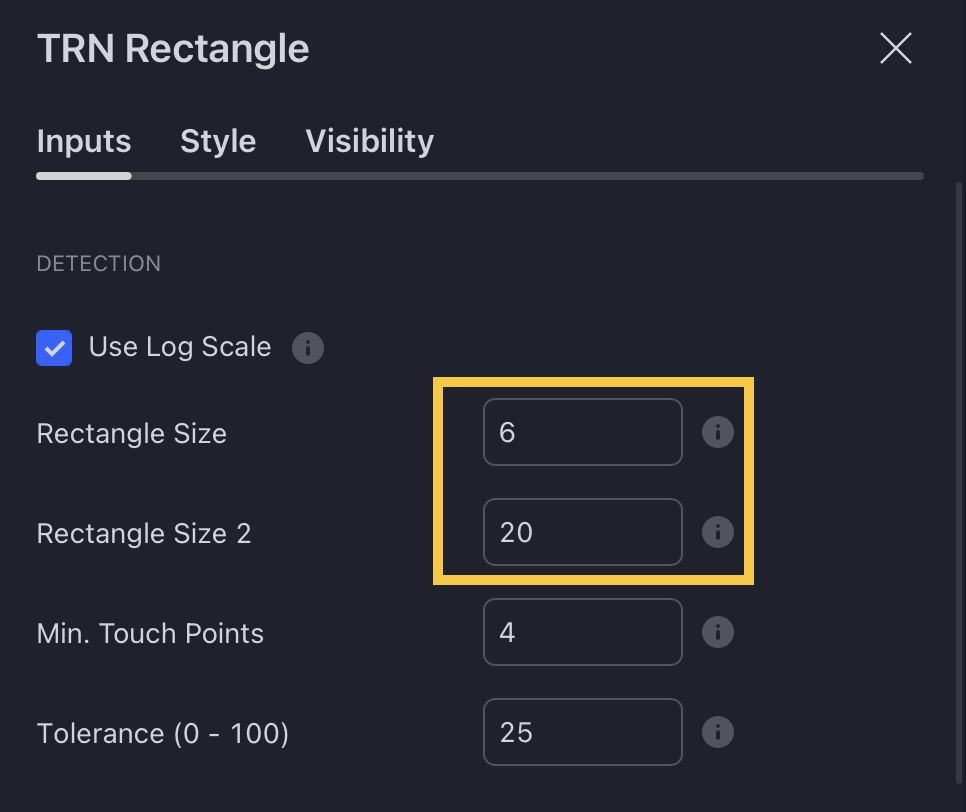

Adjust the swing size in the indicator settings to align with your preferences. Some of our pattern indicators scan for patterns using two different swing sizes simultaneously like the Consolidation and Range Pattern.

To visualize swings, add our Swing Suite indicator to your chart and select the same swing size as configured for pattern detection. Be sure to check out our Swing Suite section to learn more about our powerful tool.

After choosing your preferred swing size, refer to the pattern statistics to evaluate the performance of detected patterns.

Select The Right Accuracy

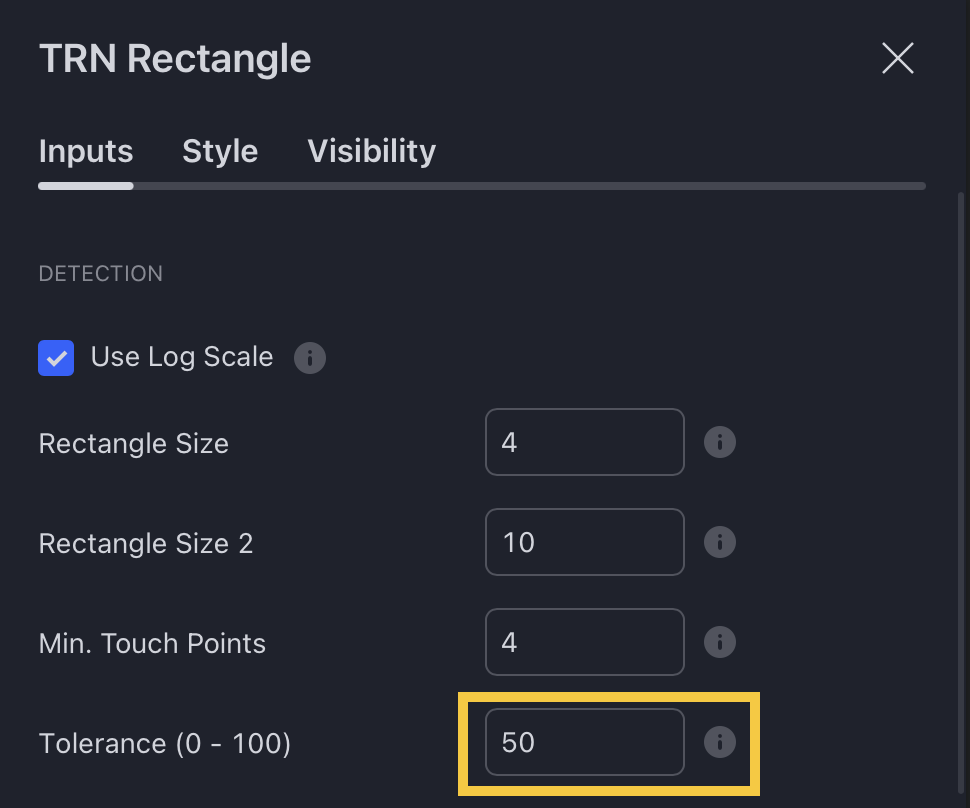

To detect more patterns, increase the tolerance level, even though it may result in lower accuracy.

However, be mindful that a higher tolerance level may result in more patterns hitting their stop loss. Opt for a tolerance level that yields favorable statistics, focusing on trading patterns with a proven performance history.