Breakout Conditions

In the realm of trading, identifying breakout conditions is paramount for successfully recognizing and capitalizing on chart patterns. Trading tools equipped with diverse breakout conditions offer traders a comprehensive approach to deciphering market trends and making informed decisions.

This section delves into the world of breakout conditions built within the TRN Chart Patterns, exploring their functionalities, applications, and the benefits they provide in the realm of chart pattern recognition.

Trend Bars Pro

Trend Bars Pro Signal + Trend

If you use this breakout condition, the breakout is determined by the next signal bar or trend change of the Trend Bars Pro after one of the harmonic patterns has been completed. These Breakout condition gives you the accurate trend recognition of the Trend Bars Pro to find the perfect entry.

Trend Bars Pro Signal

If a harmonic pattern gets completed and you use this breakout condition, the breakout will be determined by the next confirmed signal bar of the Trend Bars Pro. These Breakout Condition delivers signals with reenforced reliability but they occur not as often as other breakout conditions.

RSI Crossing

With this breakout condition, a breakout for a long position gets determined, when the RSI line crosses above the RSI moving average (MA) after one of the harmonic patterns was completed. A bearish breakout after a completed harmonic pattern gets determined, when the RSI line crosses below the RSI MA.

MACD Crossing

If a harmonic pattern gets completed and you use this breakout condition, the breakout gets determined, when the MACD line crosses above the signal line (bullish MACD crossover) for a bullish breakout. Conversely, when the MACD line crosses below the signal line (bearish MACD crossover), a bearish breakout gets determined after a harmonic pattern was completed.

Swing Flip

Use this breakout condition, if you want a breakout to get determined when the next swing after point D gets detected by TRN Swings.

Close Below/Above Last 2 Lows/Highs

With this breakout condition, a breakout for a short position gets determined, if a close below the lows of the last 2 bars gets detected. For a long position, the breakout gets determined if a close above the highs of the last 2 bars gets detected.

Close Below/Above Last 3 Lows/Highs

In this scenario, a short position breakout is confirmed if the price closes below the lows of the previous 3 bars. Conversely, a long position breakout is confirmed if the price closes above the highs of the last 3 bars.

Be sure to check out our Trend Bars Pro. SMT/Divergence Suite, Swing Suite section to fully understand what lies behind the distinct breakout conditions of the TRN Chart Patterns.

How To Setup Breakout Conditions

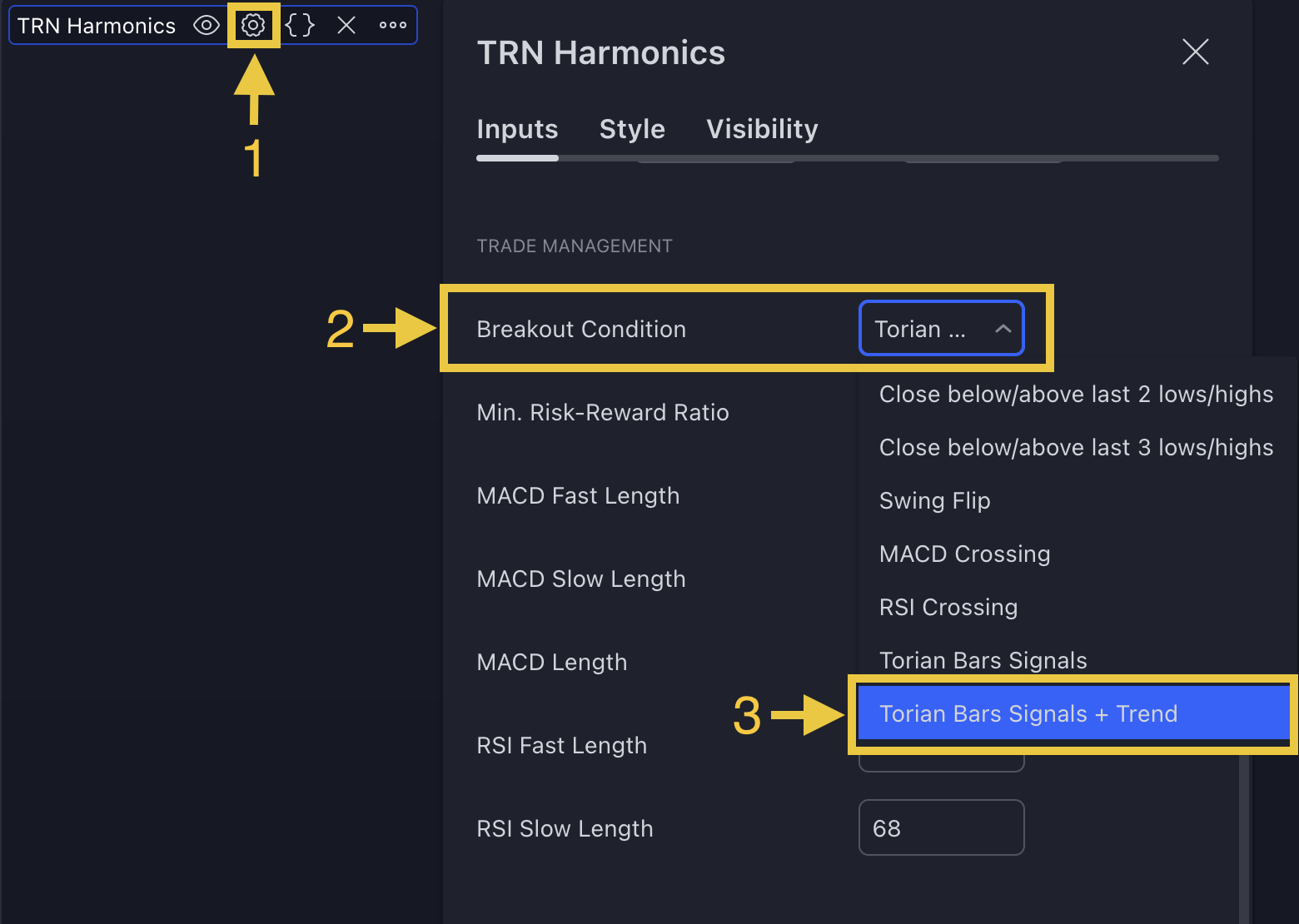

Go to indicator settings (1) and choose one of our build in breakout conditions under the section "Trade Management" of the menu item "Inputs" (2), like for example Trend Bars Pro Signal + Trend (3). A selection of 7 distinct breakout conditions is at your disposal.

If you use the default settings of the TRN Chart Patterns, Trend Bars Pro Signal + Trend will be the breakout condition for your chart patterns.