SMT/Divergence Suite Introduction

Introduction

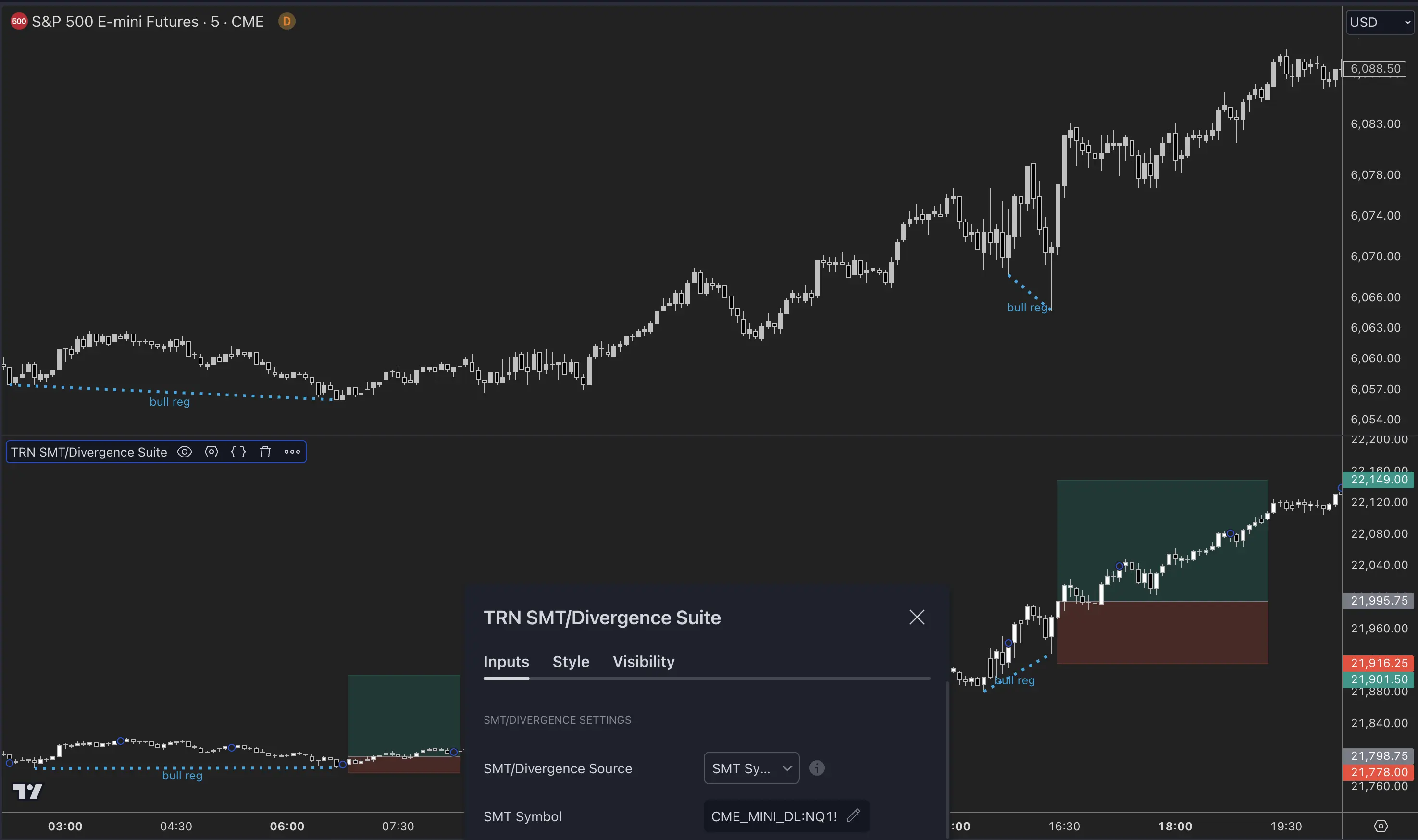

The TRN SMT/Divergence Suite detects bullish and bearish divergences, both regular and hidden, with exceptional accuracy. It has 11 built-in oscillators. Unlike other divergence indicators, it works with any given indicator—including custom ones—as well as between any two instruments, utilizing the Smart Money Technique (SMT). Its rigorous methodology ensures it precisely identifies extreme swing points in both price and the corresponding indicator or instrument, delivering a level of precision unmatched by other tools on TradingView. By pinpointing potential trend shifts before they occur, the TRN SMT/Divergence Suite provides traders with a decisive edge.

Features

Quick Start Divergence Detection

To get started with the Divergence Detection:

- Select your preferred oscillator

- Configure the parameters if needed (default settings are optimized)

- Look for divergence signals marked on your chart

- Use these signals in conjunction with other technical analysis tools

Quick Start SMT Detection

To get started with the SMT Detection:

- Select your preferred market

- Look for SMT signals marked on your chart

- Use these signals in conjunction with other technical analysis tools

- Use the SMT Divergences to make trading decisions