How To Trade Consolidation And Range Pattern

The Consolidation And Range Pattern is a technical analysis chart pattern that can be used to signal a period of consolidation in a market. To trade the Consolidation And Range Pattern, you can use the following steps:

1. Identify The Pattern

Add the Consolidation And Range Pattern to your chart and look for the pattern on the asset and timeframe of your choice.

You can also use the alerts to easy getting notified when a pattern is in the making or gets confirmed on the Symbol and timeframe of your choice. Please check out our Alerts section to learn how to use them.

With our Market Scanner you can search for rectangle patterns on up to 40 different symbols at the same time. Just get notified when a pattern is found, breaks out or is confirmed.

Visit our Chart Pattern Scanner section to see how it works.

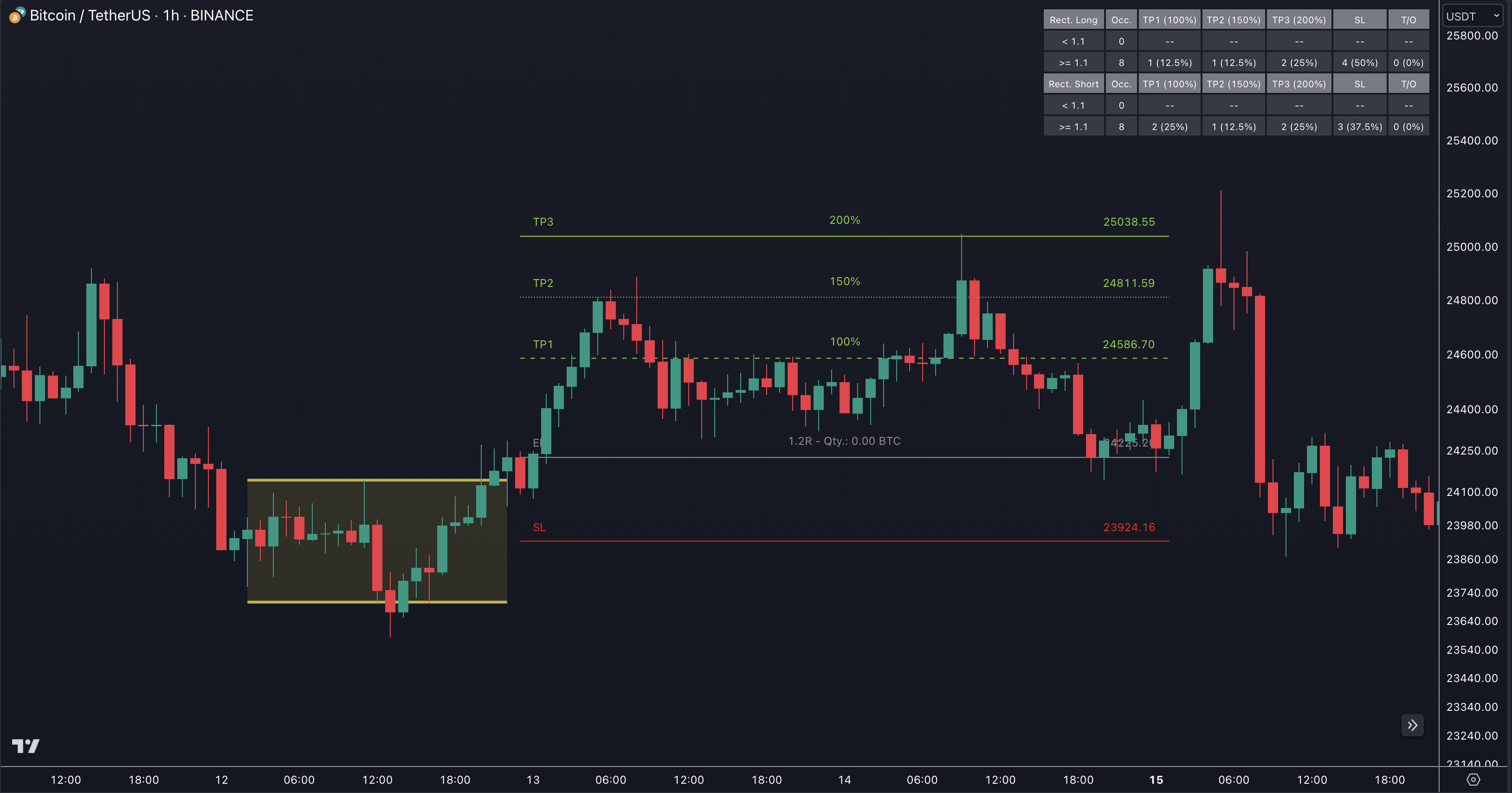

2. Identify The Breakout Point

Look for the grey line (EP) at the point where the price breaks through the resistance or support levels, indicating that the consolidation period is over.

3. Place Your Order

Once a breakout has been confirmed, place a buy order near the price level of the grey entry point line (EP) above the resistance for a long position, or place a sell order near the price level of the EP line under the support for a short position.

Our Pattern Statistics make it easy for you to see how successful a Pattern is on the Asset and timeframe you are watching. You should always check them out before entering a trade. Visit our Pattern Statistics section to learn how to use and adjust them correctly.

4. Set Stop-Loss and Take-Profit Levels

Set your stop-loss at the price level of the red stop-loss line (SL). Set your take-profit at the price level of one of the green take-profit-lines (TP1, TP2, TP3). Take into account that your risk/reward ratio (R) was calculated on the basis of TP1.

Enhance the precision and effectiveness of your stop-loss and take-profit orders by leveraging the Swing Statistics feature in our Swing Suite tool. Visit our How To Use Statistics section to gain valuable insights on how to utilize this tool to its full potential.

Use our build in Risk Management feature to optimize your trade. Check out our Risk Management section if you want to know the details.

5. Monitor Your Trade

Keep an eye on the market and be prepared to adjust your stop-loss and take-profit levels as needed.

Utilize the Trend Bars Pro to effectively monitor your trades. Discover the inner workings of this tool by referring to the designated section How To Use Trend Bars Pro.

Rectangle patterns are not always reliable. There are many other factors that can affect the price of a stock or other market. Additionally, it is important to consider your own risk tolerance and investment goals when making any trades.