Risk Management

It is crucial for traders to understand the importance of risk management in trading. Risk management refers to the process of identifying, assessing, and controlling risks that may arise during trading activities. Effective risk management is essential for traders, as it can help to minimize losses and increase profitability.

The following are some key steps that traders can take to effectively manage risks:

Develop a Trading Plan: A trading plan outlines the rules and strategies that traders will use when trading. It is essential to have a plan in place that outlines risk management strategies, such as stop-loss orders and position sizing.

Identify and Assess Risks: Traders must identify and assess the risks that may arise during trading. This may include market risks, operational risks, and credit risks.

Use Stop-Loss Orders: Stop-loss orders are an effective risk management tool that can be used to limit losses. A stop-loss order is an order placed with a broker to sell a security when it reaches a certain price.

Diversify Portfolios: Diversification is a strategy that involves spreading investments across different asset classes to reduce the risk of loss. Traders can diversify their portfolios by investing in different stocks, bonds, and other assets.

Monitor and Manage Risk: Traders must continually monitor and manage risks to ensure that their portfolios are aligned with their trading plan. This may include adjusting stop-loss orders and position sizes as market conditions change.

How To Use Our Risk Management Feature

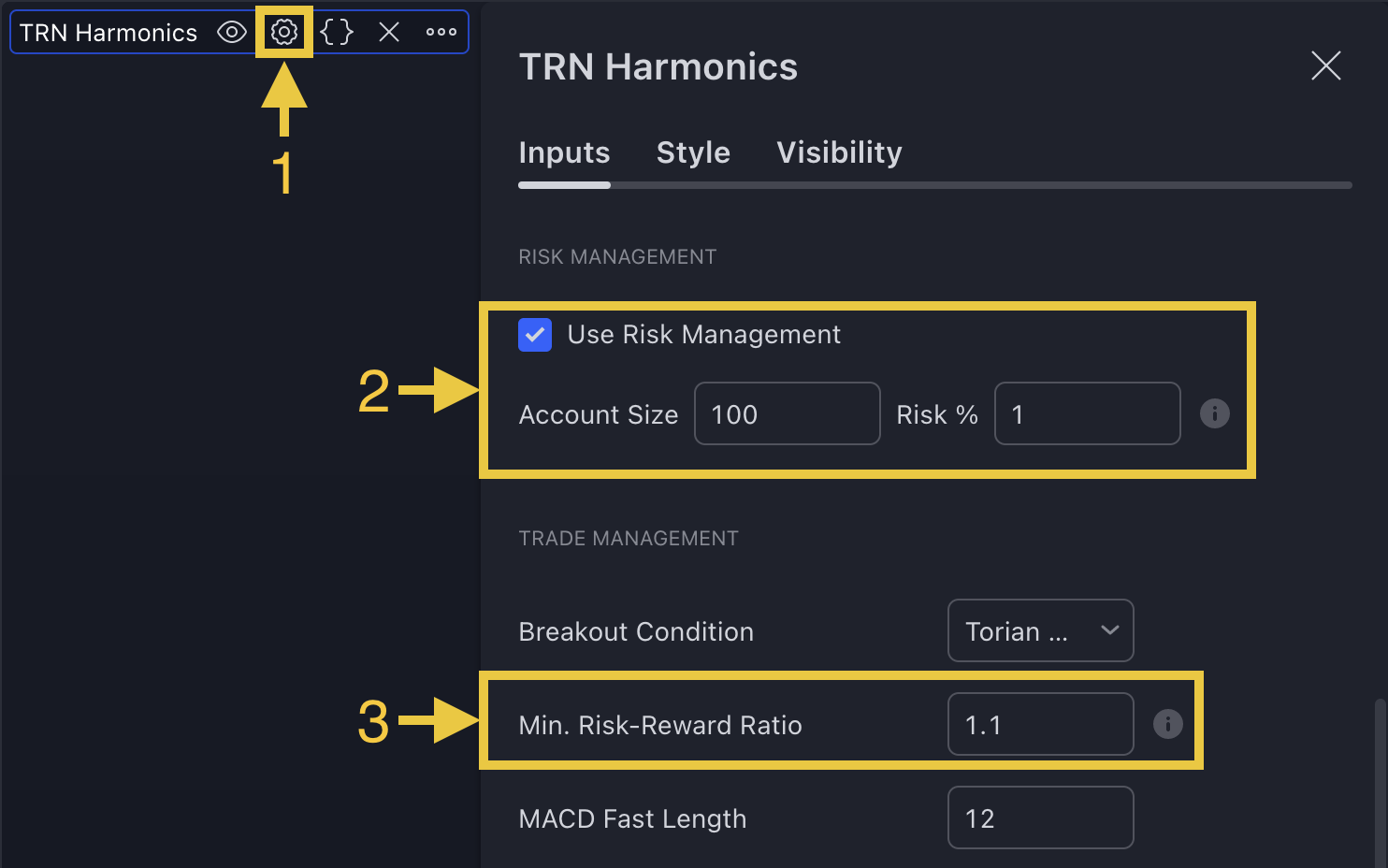

Each of our chart patterns comes with a built-in risk management feature. Just go to the settings of the respective pattern (1) and scroll down to the section "Risk Management" (2).

Here you can enter your Account Size and the percentage you want to Risk when opening a position after a pattern breakout.

In the "Trade Management" section, you have the option to define the minimum accepted risk/reward ratio (3) for confirmed chart patterns. This means that breakouts of patterns failing to meet the minimum risk/reward ratio will not be considered as confirmed signals.

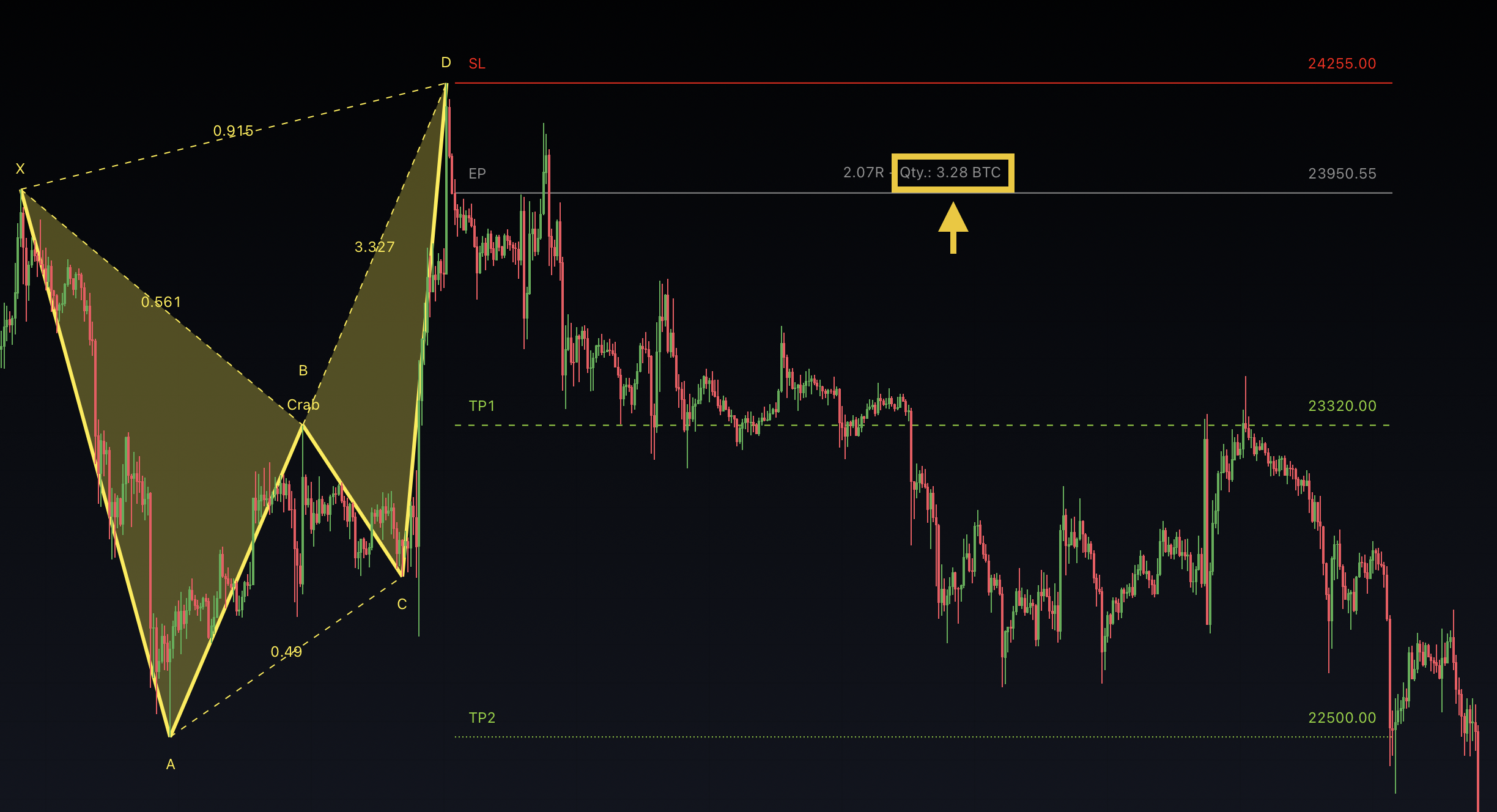

If a breakout gets confirmed, our indicators automatically calculates the position size (Quantity) you have to trade to risk as much from your account size as you entered into our risk management feature. You can read the quantity (Qty.) from the gray entry point line (EP), which is located to the right of the risk/reward ratio (R)